How much money did you save when you were young? Would your savings have helped you make it through the pandemic? Did you even know what a 401(k) was when you were younger?

According to a Travis Credit Union survey of 1,859 US Millennials and Generation Zers, 99% of young adults said that saving money is important to them. What the credit union did next was look in detail at what they actually do with their money.

Saving and investing are high on the list

The survey results are encouraging. Young adults today not only talk about money, they also seem to be doing some of the right things when it comes to saving and investing.

On average, 90% had opened a dedicated savings account by age 19 and saved an average of $14,140 with men saving $16,631 while women saved $11,649.

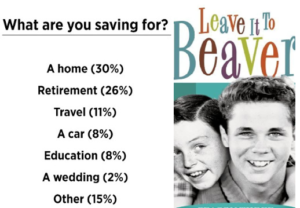

On the list of savings priorities were a home (30%), retirement (26%), travel (14%), a car or education (8%), a wedding (2%), other goals. It looks like our kids have turned into June and Ward Cleaver from the popular 1960s sitcom “Leave It to Beaver.”

Among the 50% who say they are trying hard to save for retirement, the most popular type of retirement account is a 401(k) (34%), followed by a Roth IRA (20%), and separate personal savings account (20%).

Not so fast, a few discrepancies

There are a few clouds hanging over this rosy money picture, however.

While 66% said they are well on their way to reaching their savings goals, 54% were not happy with their results so far. Of the one in 10 who don’t have a savings account, 77% said they don’t make enough money to save, 13% didn’t know where to save their money, and 10% said they didn’t know how to save their money.

Seems like a little bit of financial education could go a long way here.

Not surprisingly given the pandemic, eight out of 10 said they’ve experienced stress or anxiety when it comes to saving money, but 64% said they have saved for an emergency including job loss (33%), medical emergencies (27%), and major home or car repairs (8%).

COVID-19 is eating up savings

Young adults believe they can survive an average of 4.5 months with their emergency savings but 39% have already had to dip into their savings during COVID-19 using up an average of 33% of their emergency savings so far.

That emergency spending has gone where you’d expect it to go, including food (77%), utilities (48%), rent or mortgage (41%), credit card debt (25%), student loans and car payments (22%), and healthcare costs (19%).

Pandemic will shape future savings

Some of these young adults have been through the previous financial crisis but 73% say this pandemic will shape their financial habits in the future. 45% claim they will try to save more and manage their money better in the future, while 43% hope to contribute more to their savings, 39% will build another emergency fund, and 28% will contribute more to retirement savings like their 401(k) in the future.

Sounds like these young adults have a fairly good handle on their financial future if they can only make it through the current pandemic. Fingers crossed.