When it comes to digital banking, even with the coronavirus crisis, the traditional banks seem to have customer satisfaction sewn up.

Seem ironic? New research from JD Power not only shows the shift to digital banking and payment solutions is accelerating faster than anticipated due to coronavirus, but the big banks are also getting higher customer satisfaction ratings than digital-only financial providers.

That presents a problem and a challenge for big financial institutions as the COVID-19 pandemic places constraints on in-person retail banking and forces customers to increase reliance on digital service channels.

According to the JD Power 2020 US Retail Banking Satisfaction Study released last week, 52% of retail bank customers were classified as “branch dependent” before the coronavirus pandemic, and successfully transitioning them to digital – without compromising customer experience – will be critical in the weeks and months ahead.

“With fewer customers visiting branches, it will be important for retail banks to replace the in-person service they would have provided with personalized services delivered instead through digital channels,” said Paul McAdam, senior director, banking intelligence at JD Power.

“Given the technology available to banks, customer pain points with digital should be easy to address. Let’s keep in mind that digital retail banking was introduced 25 years ago. Executing basic user-friendly functionality, providing a full range of services, and offering easy ways to pay and move money are areas where banks could improve their digital offerings,” McAdam said.

Research shows traditional bank customers more satisfied

The most satisfied retail banking customers use both branch and digital services to conduct their personal banking, while the least satisfied are those who have a digital-only relationship with their bank and do not use branches.

Prior to the COVID-19 pandemic, 52% of retail bank customers were classified as “branch dependent”, meaning they either used the branch exclusively (10% of customers) or used a combination of branch visits, online and mobile banking service (42% of customers) during the past three months.

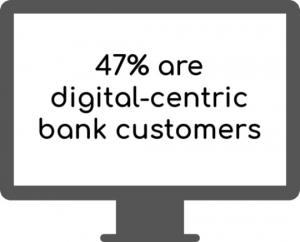

Branch-dependent customers visit a branch an average of 1.5 times per month. After 25 years of bank investment in providing and upgrading digital offerings and customers’ increased adoption of them, 32% of bank customers now do their banking in a digital-only manner and do not use branches.

JD Power research found digital-only customers have the lowest level of satisfaction with their bank. The more customers moved towards digital-only banking, the less satisfied they became with services.

“The overall satisfaction score among branch-dependent bank customers is 824 (on a 1,000-point scale), which is 23 points higher than the score among digital-only customers. That satisfaction gap is widest (31 points) among members of Generation Y,” the report said.

P2P providers making progress

P2P payment integration emerged as the wildcard for customer satisfaction according to JD Power. Customers who linked their bank accounts to digital payment services such as PayPal (43%), Zelle (15%), Venmo (13%), and Apple Pay (10%) expressed higher levels of satisfaction compared to those who do not use digital payment services.

Zelle’s penetration with retail banking customers has grown in recent years, fueled by increased adoption among both young and older consumers. Among Gen Z and Gen Y retail banking customers, 27% report linking Venmo to their primary bank’s checking account compared to 24% for Zelle. But it’s another story among older consumers. Of Gen Z, Boomer and PreBoomer (Silent Generation) customers, 6% report linking Venmo, and 12% report linking Zelle to their bank checking account.

“Zelle attains strong satisfaction ratings for a few reasons. It’s nicely integrated with the mobile banking apps of the participating banks, meaning it’s easy for customers who already have their bank’s mobile app to start using Zelle. Zelle enables customers to move money from one bank to another, without needing to get a third party involved,” said McAdam.

“This is important, as some customers place more trust in their bank to protect their personal financial data and money more so than third-party technology companies. Also, Zelle does not charge fees to send or receive money. Some other P2P payment providers charge fees if users send money using a credit card or for immediate payments,” he noted.

Big Six banks led in digital engagement

The Big Six banks – Bank of America, Chase, Citibank, PNC, US Bank, and Wells Fargo – led midsize and regional competitors on building digital engagement with competitors. Prior to the pandemic, 49% of big bank customers had high levels of digital engagement, compared with 41% of regional bank customers and 36% of midsize bank customers.

The largest banks do have competitive advantages compared to their smaller peers when it comes to technology and digital engagement.

“Greater size and operating scale enable the largest banks to spread their technology investments across far more customers. The largest banks have been very active in patent formation associated with innovative technologies and they are able to spread technology investments into more-specialized areas (e.g. emerging payments, digital deposit generation, online lending, online wealth management services, etc.). The largest banks tend to invest early in new financial services technologies and influence the industry standards associated with these services,” McAdam said.

The big banks also tend to offer a more comprehensive mix of financial accounts and services – the one-stop-shop that can manage all of a customer’s money. McAdam said the one-stop-shop is attractive to some consumers, and this also helps to improve engagement levels. “In addition, the largest banks have done a good job of building market share among younger customers (Gen Z and Gen Y). Younger customers are more likely than older to be highly digitally engaged.”

Which banks scored highest in customer satisfaction?

The JD Power study examined banks in 11 US geographic areas according to six key factors: account opening; communication and advice; channel activities; convenience; problem resolution; and products and fees. Channel activities included seven subfactors: ATMs; assisted online; branch; call center; IVR; mobile; and website.

The banks with the highest overall satisfaction ratings from customers by region included:

California Region: Chase (825) Bank of the West (824), US Bank (820)

Florida Region: Chase (851), TD Bank (837, Regions Bank (836)

Mid-Atlantic Region: S&T Bank (871), Northwest Bank (850), New York Community Bank (832)

Midwest Region: First National Bank of Omaha (847), Capital Federal (837), Regions Bank (835)

New England Region: Bangor Savings Bank (863), Rockland Trust (852), Eastern Bank (837)

North Central Region: City National Bank (WV) (857), Huntington (852), Chase (844)

Northwest Region: Columbia Bank (837), Banner Bank (834), Umpqua Bank (808)

South Central Region: Arvest Bank (863), Chase (848), Simmons Bank (847)

Southeast Region: United Community Bank (862), Synovus Bank (852), First, Citizens Bank (838)

Southwest Region: Arvest Bank (851), Bank of Oklahoma (844), BancFirst (838)

Texas Region: Frost Bank (863), Woodforest National Bank (856), Prosperity Bank (847)

The regional averages for customer satisfaction with banks also tell an interesting story. By region the average customer satisfaction ratings from highest to lowest were South Central (830), North Central (827), Florida (827), Texas (824), Southeast (822), Mid-Atlantic (816), Southwest (810), California (803), Northwest (802), Midwest (801), and New England (801).

It seems bank customers in the Midwest, New England, California, and the Northwest, just don’t care for their banks as much as those in other regions of the US.

The path ahead for the Big Six banks as well as regional competitors is all about incorporating and expanding digital services. The challenge is how to maintain customer satisfaction through growing digital channels and a diminishing branch network.

You can read more detail about the JD Power US Retail Bank Satisfaction Study here.