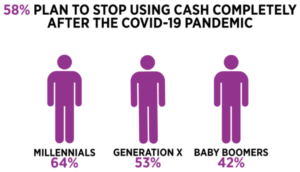

New research suggests 58% of US consumers will stop using cash after the coronavirus pandemic ends.

According to the September 2020 study by Travis Credit Union (TCU), consumers are now twice as likely to use a debit or credit card instead of cash to purchase goods and one in five said they rarely or never carry paper bills.

It looks like the combination of new digital payment options, innovative technologies, and the impact of COVID-19 have finally pushed Americans to adopt digital payments faster than the slower pace they were following compared with the rest of the world.

Cash is still around but fewer are using it

Researchers found fewer than one in five consumers (16%) said they always carry cash, while 27% said they carry it most of the time, and 37% responded ‘sometimes.’ When Americans do have cash in their pocket, purse, or wallet, they’re carrying an average of $46.

When it comes to carrying cash, there’s a distinct difference between the generations with 40% of millennials carrying an average of $47, 45% of Gen X carrying an average of $47, and 59% of baby boomers with $42 in their pockets.

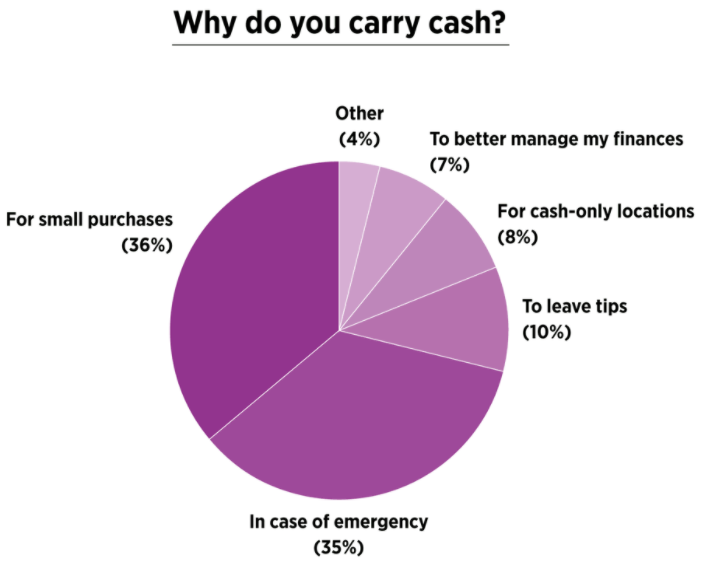

The reasons for carrying cash are varied and include: using it for small purchases (36%), for emergency use (35%), to leave tips (10%), for cash only locations (8%), to better manage finances (7%), and other uses (4%).

Interestingly, 62% of consumers said they are less likely to spend more when using cash.

Digital payment preferences shifting

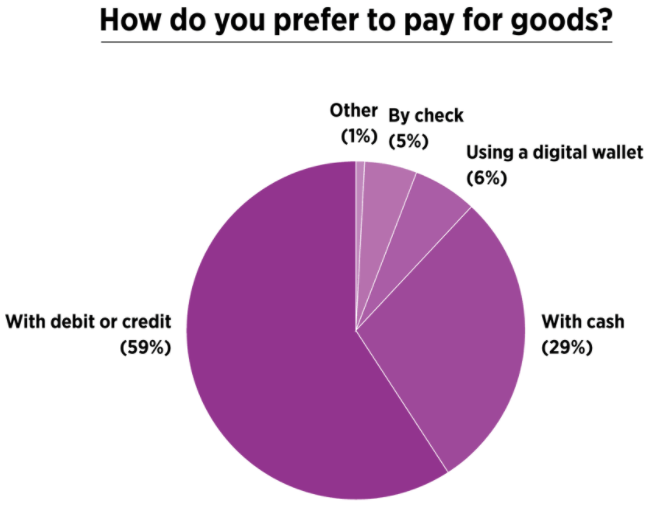

Of most interest to merchants is how consumers now prefer to pay for goods including debit or credit card (59%), cash (29%), digital wallet (6%), check (5%), and other (1%).

Consumers simply prefer buying with debit or credit cards because of the ease and convenience (52%), safer than using supporting as (24%), more hygienic than cash (11%), instant information on the state of finances (9%), and other reasons (4%).

US consumers now seem ready to embrace digital with 58% saying we should move entirely to a cashless system with 69% saying they foresee a cashless future. 63% of respondents said they have shopped at a cashless business. According to the report, most often, the cashless customers were millennials (68%), followed by GenX (60%), and baby boomers (46%).

While half of those surveyed said they are using less cash than prior to the pandemic, 50% were still using singles and sawbucks for payments. One in three however said they were not using cash because of health concerns and 50% said they had avoided a purchase that called for cash.

Researchers also found there was a national coin shortage which made it difficult for consumers to make small purchases (41%), make or get change (26%), or run errands such as using the laundromat (22%).

Several discrepancies were noted in the research among ethnic groups as a result of coin shortage including Native Americans (80%), Hawaiian or Pacific Islanders (67%), and Hispanics and Latinos (56%). Caucasians (46%) and Asians (34%) were least likely to be affected by the coin shortage.home

58% will stop using cash after COVID-19

Let’s come back to that most important finding that 58% of those surveyed said they plan to stop using cash after COVID-19 ends. That has big implications for retailers in the future.

Despite the potential difficulties it presents to unbanked or credit-challenged individuals, cashless businesses are increasingly common despite some jurisdictions limiting or restricting them.

As we’ve noted before, prior to the pandemic, the US was lagging behind other nations including China, the EU and even some developing countries when it comes to use of digital wallets and other forms of digital payments. COVID-19 has changed the digital payments equation forever.

The future of payments is overwhelmingly digital and much more open to new product offers, new technology, increased security, and innovations by new players in the payments space. As we head into the 2020 holiday shopping season, the customer journey is moving faster and farther into the digital future.

Regardless, the future of payments is overwhelmingly digital and subject to new product offers, new technology, increased security, and innovations by new players in the payments space.

You can view the detailed 2020 Travis Credit Union Cash Survey and infographics here.

Graphics courtesy of Travis Credit Union