We’ve got a full roundup of the latest global payments news, starting with Apple Pay’s plans to add a new peer-to-peer payment feature later this year, letting users send and receive money from friends. Global Payments will drive Hyundai’s new online car buying platform Click To Buy allowing users to buy a car via smartphone.

Wall Street is positive on PayPal and its profits and 25% growth in transactions in the e-commerce payment space. Called ‘Grab + Go‘, a new payment app being tested by Barclaycard could turn businesses into faux Amazon Go stores where buyers scan to pay for products and leave the store without going through a checkout. As India consolidates its various taxes into a single GST on July 1, some are wondering if it will impact e-commerce in the growing economy.

Wall Street is positive on PayPal and its profits and 25% growth in transactions in the e-commerce payment space. Called ‘Grab + Go‘, a new payment app being tested by Barclaycard could turn businesses into faux Amazon Go stores where buyers scan to pay for products and leave the store without going through a checkout. As India consolidates its various taxes into a single GST on July 1, some are wondering if it will impact e-commerce in the growing economy.

Shopify rolled out an e-commerce channel for game developers allowing players to purchase products without leaving their game. A fascinating, out-of-the-box idea that could pay back hugely. China rivals Tencent and Alibaba compete bitterly in the e-commerce, payments and now, the in-store mobile payments and food delivery space. Tencent seems to be gaining ground.

Shopify rolled out an e-commerce channel for game developers allowing players to purchase products without leaving their game. A fascinating, out-of-the-box idea that could pay back hugely. China rivals Tencent and Alibaba compete bitterly in the e-commerce, payments and now, the in-store mobile payments and food delivery space. Tencent seems to be gaining ground.

PayPal and Canada Post launched a new integrated payment and shipping solution for small business aimed at simplifying online sales and shipping. Faster payments is just one driver of consumer interest according to a consumer trends survey from Fiserv. 76% of consumers would like to see real-time payments.

Apple Pay takes on Venmo with peer-to-peer payments

You’ll soon be able send and receive money from your friends within Apple Pay. The new feature was announced at WWDC, Apple’s annual developer conference. Much like money transfer app Venmo, Apple Pay can now support peer-to-peer payments.

You’ll soon be able send and receive money from your friends within Apple Pay. The new feature was announced at WWDC, Apple’s annual developer conference. Much like money transfer app Venmo, Apple Pay can now support peer-to-peer payments.

The feature will be integrated directly into iMessage, so users can send money directly within a conversation with a friend. The feature will use Touch ID to make sure the transfers are secure.

Once transferred, the money will go into an Apple Pay cash card. You’ll then be able to send that card to friends or family, or transfer it directly to your bank. Via businessinsider.com

Global Payments Provides Services for Car Sales

Global Payments, a provider of payment technology services around the world, announced Wednesday (May 31) it inked an agreement with Hyundai Motor U.K. to provide payment technology services to Hyundai Motor U.K.’s online car buying platform, Click To Buy.

Global Payments, a provider of payment technology services around the world, announced Wednesday (May 31) it inked an agreement with Hyundai Motor U.K. to provide payment technology services to Hyundai Motor U.K.’s online car buying platform, Click To Buy.

In a press release, Global Payments said Click To Buy is the first car buying platform where customers nationwide have the opportunity to buy a car from any participating Hyundai Dealership in the U.K., all from their computer or mobile device.

“One of the last areas of retail to embrace true online shopping has been car sales,” said Nigel another way to your,back to the war sure you are you are well president and managing director U.K., Global Payments, in the press release. “Ecommerce has changed the way we shop, and the online car buying experience provided by Hyundai’s Click To Buy is transformational to this industry. This software-enabled technology allows customers to now have more choice in how and when they can purchase a car.” Via pymnts.com

Wall Street says PayPal will keep surging due to online payments dominance

Robert W. Baird reiterated its outperform rating on PayPal shares, one of the market’s best-performing stocks, predicting the online payments company’s earnings will top expectations next year.

Robert W. Baird reiterated its outperform rating on PayPal shares, one of the market’s best-performing stocks, predicting the online payments company’s earnings will top expectations next year.

“We believe that the split from eBay represents a rebirth of a platform that already has the benefit of global scale, a trusted brand, and mobile orientation,” analyst Colin Sebastian wrote in a note to clients Friday. “PayPal’s significant growth opportunities stem from the disruption in financial services caused by the digitization of money and broader shift to the mobile web.”

He cited how PayPal continues to take online payments market share with its transaction volume rising 25 percent per year compared with the e-commerce industry’s “mid-teens growth.” He also noted that PayPal users spend twice as much online as non-PayPal customers, which is attractive to merchants. Via cnbc.com

Barclaycard trialing Grab Go ‘pocket checkout’ payment method

Mobile technology solutions provider Apadmi recently released research that showed consumers want to see more technology used in stores. Nearly half (46%) expect free in-store wi-fi and one in five want a more personalized in-store experience via tech such as mobile apps.

Mobile technology solutions provider Apadmi recently released research that showed consumers want to see more technology used in stores. Nearly half (46%) expect free in-store wi-fi and one in five want a more personalized in-store experience via tech such as mobile apps.

“There is a need among consumers for retailers to make better use of technology in-store to make every aspect of the shopping journey more enjoyable,” said Nick Black, CEO of Apadmi. “As shoppers continue to embrace mobile e-commerce and retail apps, the in-store experience needs to remain relevant and incorporate the benefits that can be achieved through shopping online.”

A new app payment method being trialed by Barclaycard may go a long way to providing shoppers with the speed and convenience they crave. Called ‘Grab Go’, the app allows shoppers to scan items they want to purchase via a smartphone’s camera before paying with one click. The payment method uses pre-loaded payment details and stores a receipt within the app. Via bizreport.com

Will GST’s Complex System Hamper E-Commerce in India

Come July 1, 2017, all the major taxes in India like excise duty, octroi, service tax, special additional duty and VAT will be subsumed into a single tax called GST. But, even with the final deadline hardly a month away, there is still a lot of confusion around some aspects of its regulation and implementation. Further, how the tax will end up affecting various sectors of the Indian economy is also a question that a lot of people are currently seeking answers to. One of the sectors in the spotlight in regards to this is the Indian e-commerce sector.

Come July 1, 2017, all the major taxes in India like excise duty, octroi, service tax, special additional duty and VAT will be subsumed into a single tax called GST. But, even with the final deadline hardly a month away, there is still a lot of confusion around some aspects of its regulation and implementation. Further, how the tax will end up affecting various sectors of the Indian economy is also a question that a lot of people are currently seeking answers to. One of the sectors in the spotlight in regards to this is the Indian e-commerce sector.

The Indian e-commerce market is acknowledged as a rapidly growing market and is estimated to have crossed the two lakh crore rupees turnover mark in December last year.

Till now, 18 Indian states have officially passed the SGST bills in their state assemblies. This means, the landmark change in tax regime might be finally becoming a reality by July 1 after having missed its previous deadline. In this article, Indianweb2 tries to find out if GST’s complex system will hamper the e-commerce business in India. Via indianweb2.com

Shopify Rolls out E-commerce Channel for Game Developing Companies with Apple Pay

Shopify – the Ontario-based online giant lets you set up online stores in order to sell your goods with equal support for organizing products, customizations, payment gateway integration, tracking and responding to orders all within a few clicks away. The same company is now helping gaming developer giants like Activision Blizzard Inc, Electronics Arts Inc & Take-Two Interactive Software Inc and various other companies to monetize their e-commerce with a new SDK (software development kit) called Unit Buy.

Shopify – the Ontario-based online giant lets you set up online stores in order to sell your goods with equal support for organizing products, customizations, payment gateway integration, tracking and responding to orders all within a few clicks away. The same company is now helping gaming developer giants like Activision Blizzard Inc, Electronics Arts Inc & Take-Two Interactive Software Inc and various other companies to monetize their e-commerce with a new SDK (software development kit) called Unit Buy.

Using “Unit buy” the players have an option to choose and purchase branded products related to the games they are playing without leaving the game which equates like ordering from a regular traditional retail store. During the game itself, you can directly order products of your choice which will be based on the real scenario of the game being played.

Basically, the Unit Buy SDK helps gaming developers to add commercial entities to games made with the Unity game engine which can be used to connect with the in-game purchase experiences with physical products in Shopify. In addition, the SDK also assists in order to fetch information about a single product or a collection of products, create an in-game shopping cart where customers can select product options and quantities & generate a checkout for a single product or an entire cart. Via technosamigos.com

Tencent Making Headway Versus Alibaba

In a saturated e-commerce market, Chinese e-commerce giant Alibaba and its biggest competitor, Tencent Holdings Limited, have their eyes on diversification, and Alibaba is losing ground. Like their American counterpart Amazon, Alibaba and Tencent are fashioning themselves identities that have less and less to do with online shopping and more to do with an integrated life approach. The latest additions? Food delivery and mobile payments at even more physical stores.

In a saturated e-commerce market, Chinese e-commerce giant Alibaba and its biggest competitor, Tencent Holdings Limited, have their eyes on diversification, and Alibaba is losing ground. Like their American counterpart Amazon, Alibaba and Tencent are fashioning themselves identities that have less and less to do with online shopping and more to do with an integrated life approach. The latest additions? Food delivery and mobile payments at even more physical stores.

Alipay, Alibaba’s mobile payment platform, released a version in Hong Kong dollars this week. Previously, payments could only be made in yuan. 2,000 Hong Kong stores will now accept payments through the AlipayHK app, with more than 8,000 slated for conversion from the yuan platform.

Alibaba took an 18 percent stake in supermarket and convenience store operator Lianhua Supermarket Holdings, catapulting the company’s stocks as much as 34 percent during Monday morning trading (May 29). After the initial agreement in February, Lianhua said it expected the partnership to yield new technologies and integrations of logistics and payments.

Alibaba and its financial services arm, Ant Financial, are investing over $1 billion in Chinese food delivery service Ele.me. The investment will value Ele.me at $5.5 billion to $6 billion and help it compete against Tencent’s food delivery service, Meituan Dianping. Via pymnts.com

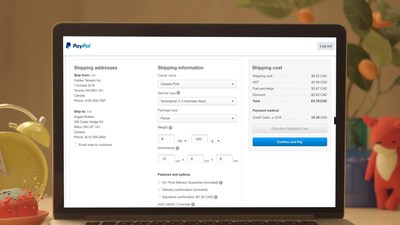

PayPal and Canada Post Announce Integrated Payment and Shipping Solution

PayPal Canada and Canada Post today announced a new integrated payment and shipping solution for the, small businesses and casual sellers. This integration aims to make e-commerce more easily accessible for entrepreneurs and small businesses including 83 per cent of Canadian small and mid-sizes businesses that currently do not sell online.

PayPal Canada and Canada Post today announced a new integrated payment and shipping solution for the, small businesses and casual sellers. This integration aims to make e-commerce more easily accessible for entrepreneurs and small businesses including 83 per cent of Canadian small and mid-sizes businesses that currently do not sell online.

Before the launch of this solution, sellers would receive orders, often write the labels manually and then visit a Canada Post retail outlet to ship the parcels. With this new integrated payment and shipping solution, online sellers can track their orders, print shipping labels and pay for shipping seamlessly using their PayPal account. This new functionality automatically sends tracking information and delivery confirmation alerts to both the seller and the customer once a shipping label is created.

For small businesses, the days of tracking orders in their PayPal account and subsequently visiting a physical Canada Post location to fulfill customer orders are over. With this new solution, users can schedule a parcel pick-up from Canada Post thereby saving time to drop off parcels to customers locally or internationally. Via mobilitytechzone.com

Fiserv survey finds payments now more mobile, more personal, while digital wallets show measured growth

The latest Expectations & Experiences consumer trends survey from Fiserv, Inc, a leading global provider of financial services technology solutions, finds consumers are paying more bills from mobile devices and making more person-to-person payments while starting to venture into digital wallets.

The latest Expectations & Experiences consumer trends survey from Fiserv, Inc, a leading global provider of financial services technology solutions, finds consumers are paying more bills from mobile devices and making more person-to-person payments while starting to venture into digital wallets.

Faster payments continue to be important to consumers, with 76 percent saying that it is at least somewhat important that the payments they make are delivered in real time.

“Consumers are living more digital lives, and that is being reflected in the way they pay,” said Mark Ernst, chief operating officer, Fiserv. “Bill payments and person-to-person payments from mobile devices are making their way toward the mainstream, while digital wallets are showing slow but steady growth reminiscent of the early days of online banking.” Via cuinsight.com

LET’S CONNECT