Today, we’ve got a roundup of global payments news and insights starting with Alibaba’s newest $1 billion investment in e-commerce group Lazada which brings its ownership to 83%. The Singapore government will allow banks to compete in non-banking related businesses such as e-commerce in order for banks to remain competitive in a changing world.

eMarketer estimates that e-commerce will make up 14.6% of retail spending or $4.058 trillion by 2020. Newly-launched Square Checkout aims to get more business from online sellers. British Bankers Association and EY report nearly 40% of UK consumers used banking apps in 2016 and the number of transactions grew by 57% in one year.

eMarketer estimates that e-commerce will make up 14.6% of retail spending or $4.058 trillion by 2020. Newly-launched Square Checkout aims to get more business from online sellers. British Bankers Association and EY report nearly 40% of UK consumers used banking apps in 2016 and the number of transactions grew by 57% in one year.

According to the European E-commerce Report 2017, EU e-commerce grew by 15% in 2016 and totalled 30% of global e-commerce. Swedish payment terminal company iZettle is signing up more than 1,000 businesses a day with strong growth in the UK as well as Scandinavia. Mobile loyalty and payments company Warply launched the new Warply Keyboard Payments for mobile payments and P2P transactions via messaging apps.

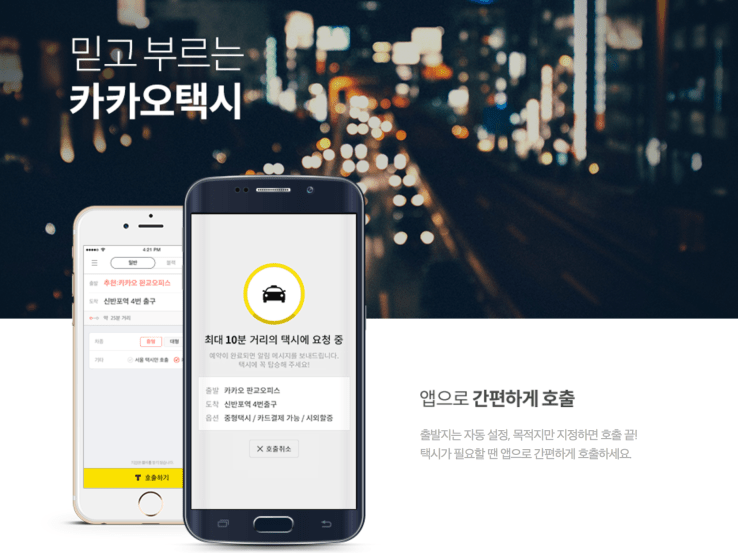

Cross-border payments startup InstaRem raised $13 million in new financing and hopes to expand from SE Asia into Europe and North America. Korean messaging  app company Kakao raised $437 million to expand its Uber-like ride service after raising $200 million for its Kakao Pay service from Alibaba’s Ant Financial.

app company Kakao raised $437 million to expand its Uber-like ride service after raising $200 million for its Kakao Pay service from Alibaba’s Ant Financial.

TransferTo and African e-commerce platform, MallforAfrica, will offer digital payments and access to over 200 major EU and US e-retailers. Payscout introduced Payscout VR Commerce – a new service that lets consumers make digital payments while enjoying virtual reality experiences.

Alibaba Invests $1 Billion in Lazada Bringing Stake to 83%

Alibaba (BABA) is spending $1 billion to boosts its stake in Lazada Group, an e-commerce company based in Southeast Asia.

Alibaba (BABA) is spending $1 billion to boosts its stake in Lazada Group, an e-commerce company based in Southeast Asia.

With the additional funding, China’s leading online retailer’s stake goes to 83% from 51%. The company said in an announcement it is acquiring the shares from certain Lazada shareholders at an implied valuation of $3.15 billion for the company, which it said is a “significant increase” since it first acquired a majority position in April of last year.

With the new $1 billion, Alibaba has invested a total of $2 billion in the firm as it looks to expand outside of its core Chinese market. Lazada CEO Maximilian Bittner told Bloomberg management and Temasek Holdings are now the only other investors. Via investopedia.com

Singapore to let banks move into e-commerce

Singapore is changing its regulations to make it easier for banks to move into non-financial but complementary business areas such as e-commerce. In a speech, Singapore’s finance minister Heng Swee Keat said that rules introduced in 2001 to ensure banks focused on their core competencies are no longer as relevant.

Singapore is changing its regulations to make it easier for banks to move into non-financial but complementary business areas such as e-commerce. In a speech, Singapore’s finance minister Heng Swee Keat said that rules introduced in 2001 to ensure banks focused on their core competencies are no longer as relevant.

“Banks are facing increasing competition from online and non-financial players that have leveraged their large user base to provide digital wallets, payments and remittance services,” he noted. Via finextra.com

True Streamlining of the Payment Process

From credit card companies to retailers and consumers, there are many key stakeholders in the commerce process, both on and offline. Without proper payment processes in place, it’s likely that the entire retail ecosystem would either grind to a halt or favor one side over another. True streamlining of the payments process where all involved parties are looked after is probably the ideal situation in retail.

From credit card companies to retailers and consumers, there are many key stakeholders in the commerce process, both on and offline. Without proper payment processes in place, it’s likely that the entire retail ecosystem would either grind to a halt or favor one side over another. True streamlining of the payments process where all involved parties are looked after is probably the ideal situation in retail.

Is true streamlining possible? Maybe. As e-commerce pushes its way onward and upward, retailers are continually looking for ways to protect consumer data while providing a quality commerce experience for all parties involved.

Out of the $22.049 trillion in total retail sales around the world in 2016, e-commerce makes up $1.915 trillion, or 8.7 percent according to eMarketer. This research forecasts that digital payments are on the rise, with eCommerce making up 14.6 percent of the total retail spend by 2020 – that’s $4.058 trillion. Via pymnts.com

Square is extending its e-commerce push to help lift the company

Square launched a new feature called Square Checkout, which will make it easier for the company’s merchants to begin using Square to sell online, according to a blog post from Square’s product manager.

Square launched a new feature called Square Checkout, which will make it easier for the company’s merchants to begin using Square to sell online, according to a blog post from Square’s product manager.

The offering, which is part of Build With Square, will allow merchants to better connect online sales with the Square Dashboard, so they can see purchasing data across channels in one place, see better buyer data, and avoid hassle associated with security standards thanks to Square’s certified offering. It will also more prominently advertise that consumers are checking out with Square, in a move to increase trust.

For Square, pushing deeper into e-commerce signifies an important recognition of payment trends. BI Intelligence forecasts that US-based e-commerce retail sales will increase to $631 billion by 2020, up from an estimated $436 billion this year. Square, which is still predominantly a brick-and-mortar-based product, likely wants to capture some of that growth. And it thinks it can use its brand recognition to do that — the firm believes that, by putting “Checkout With Square” on the page, it could improve consumer trust and increase online sales. Via businessinsider.com

UK banking app transaction numbers soar

Brits are increasingly relying on banking applications to manage their money, with nearly 40% of adults using apps in 2016 and transactions rising by 57% during the year. Over 19.6 million people used banking apps last year, up 11% on 2015, according to figures put together by the British Bankers Association and EY.

Brits are increasingly relying on banking applications to manage their money, with nearly 40% of adults using apps in 2016 and transactions rising by 57% during the year. Over 19.6 million people used banking apps last year, up 11% on 2015, according to figures put together by the British Bankers Association and EY.

Customer use of banking apps has soared by 356% between 2012 and 2017, with the number of transactions rising as customers begin to do more than simply check their account balances.

Last year there was a 30% rise in the number of Brits using apps to manage their savings, a 46% increase in those looking after their credit cards and an 86% jump in those handling mortgage and investment accounts. Nearly two thirds now use apps to transfer money, six in 10 paying other individuals and just under a quarter arranging standing orders. Via finextra.com

What’s Next for European e-commerce?

According to the latest findings of the European Ecommerce Report 2017, it is a good time to be selling online in Europe — especially since online retail growth has been “exponential” over the last several years.

According to the latest findings of the European Ecommerce Report 2017, it is a good time to be selling online in Europe — especially since online retail growth has been “exponential” over the last several years.

During 2016 alone, e-commerce activity increased by 15 percent to €530 ($602 billion U.S., 30 percent of global e-commerce). The 2017 forecast indicated a projected 14 percent growth to €602 billion ($684 billion, 34 percent of global retail sales). All in, European eCommerce accounted for 2.7 percent of 2016 global retail sales.

While the growth is impressive, the report also indicated several areas where further growth is possible and even necessary. One example focuses on European retail firms in which websites are on the rise — up from 67 percent of firms in 2010 to 77 percent in 2016 — though only 18 percent of firms can complete transactions through them. Via pymnts.com

iZettle signing up 1,000 new businesses a day

iZettle, the fast-growing Swedish payment terminal company, is signing 1,000 new businesses a day and seeing huge traction in the UK.

iZettle, the fast-growing Swedish payment terminal company, is signing 1,000 new businesses a day and seeing huge traction in the UK.

CEO and founder Jacob de Geer told Business Insider at the Money2020 conference last week: “We see our strongest growth in the UK, it’s our biggest market.”

iZettle makes a payment terminal that allows people to accept card payments using their smartphone or iPad. The company operates across 12 markets globally. iZettle, founded in 2010, only has around 500 staff globally and de Geer says the company is able to onboard so many new customers thanks to investment in machine learning. Via businessinsider.com

Warply integrates bank apps with messaging platforms

Warply – one of the top European companies in Mobile Loyalty & Payments – launched the new Warply Keyboard Payments for mobile payments and P2P transactions via messaging apps. The new innovative solution is available exclusively for mobile banking apps, globally. Warply Keyboard Payments is a unique solution, due to the fast integration process with any banking app – since it uses banks’ existing infrastructure – and the easy customization in look and feel.

Warply – one of the top European companies in Mobile Loyalty & Payments – launched the new Warply Keyboard Payments for mobile payments and P2P transactions via messaging apps. The new innovative solution is available exclusively for mobile banking apps, globally. Warply Keyboard Payments is a unique solution, due to the fast integration process with any banking app – since it uses banks’ existing infrastructure – and the easy customization in look and feel.

Through Warply Keyboard Payments, banks can be present where their customers are, on all social networks and chatting apps including FB Messenger, iMessage, WhatsApp, Skype, WeChat, Telegram etc. Everyday payments become easier and more efficient with Warply Keyboard Payments, as bank apps are capable of combing the conversational UI convenience and bank security within users’ preferred messaging applications. Via finextra.com

Cross-border payment startup InstaRem eyes IPO in 2020 after closing $13M Series B

Cross-border payment startup InstaRem has raised $13 million in new financing as it looks to expand its business, which is rooted in Asia, into Europe and North America ahead of an eventual public listing as soon as 2020.

Cross-border payment startup InstaRem has raised $13 million in new financing as it looks to expand its business, which is rooted in Asia, into Europe and North America ahead of an eventual public listing as soon as 2020.

The Singapore-based startup said the raise was led by China’s GSR Ventures, an early investor in Didi among others, with participation from Japan/Netherlands SBI-FMO Emerging Asia Financial Sector Fund. Existing backers Vertex Ventures, Fullerton Financial Holdings, and Global Founders Capital also joined the round. Instarem previously closed a $5 million Series A in March 2016.

InstaRem operates a cross-border payment service that is targeted at business users, including banks and retailers, although it does operate a consumer service. By working with banks and using wholesale rates, the firm is able to get good cross-border rates for its retail customers, too, InstaRem CEO and co-founder Prajit Nanu told TechCrunch. The company says it is processing 150,000 transfers each month, with an average size of $1,800 per transaction. Via techcrunch.com

Chat app Kakao raises $437M for its Korean ride-hailing service

Kakao’s 36-year-old CEO Jimmy Rim has been under pressure to maintain Kakao’s growth, and he’s opted to empower the firm’s business units. Today’s news comes months after Kakao granted similar independence to its Kakao Pay division, which manages its Kakao Pay mobile payment service and other financial assets. Kakao Pay also took on strategic funding, raising $200 million from Alibaba’s Ant Financial fintech unit.

Kakao’s 36-year-old CEO Jimmy Rim has been under pressure to maintain Kakao’s growth, and he’s opted to empower the firm’s business units. Today’s news comes months after Kakao granted similar independence to its Kakao Pay division, which manages its Kakao Pay mobile payment service and other financial assets. Kakao Pay also took on strategic funding, raising $200 million from Alibaba’s Ant Financial fintech unit.

Kakao’s 36-year-old CEO Jimmy Rim has been under pressure to maintain Kakao’s growth, and he’s opted to empower the firm’s business units. Today’s news comes months after Kakao granted similar independence to its Kakao Pay division, which manages its Kakao Pay mobile payment service and other financial assets. Kakao Pay also took on strategic funding, raising $200 million from Alibaba’s Ant Financial fintech unit. Via techcrunch.com

Mobile Money Network Working With MallforAfrica To Enable Digital Payments

Global B2B cross-border mobile payments network, TransferTo, is working with African e-commerce platform, MallforAfrica, to offer digital payments that give online shoppers in Africa access to over 200 major e-retailers across Europe and the U.S.

Global B2B cross-border mobile payments network, TransferTo, is working with African e-commerce platform, MallforAfrica, to offer digital payments that give online shoppers in Africa access to over 200 major e-retailers across Europe and the U.S.

Founded in 2011, MallforAfrica enables Africans to purchase products from numerous international online retailers through their e-commerce platform, and this new partnership will facilitate safer, simpler and more secure payments via mobile money wallets.

There are over 277 million registered mobile money accounts in Africa, far more than the number of open bank accounts, giving mobile money the potential to be a primary enabler of e-commerce payments in Africa, according to ITNewsAfrica. Via afkinsider.com

Making Payments Inside VR Just Got a Lot Easier With Payscout

Payscout has launched an application that enables easy payments inside virtual reality experiences.

Payscout has launched an application that enables easy payments inside virtual reality experiences.

At the Money20/20 conference in Copenhagen, Denmark, Payscout unveiled Payscout VR Commerce, which enables consumers to shop and purchase physical products while still in VR.

The Payscout VR Commerce app is integrated with Visa Checkout (VCO), which allows users to register payment credentials within the digital wallet or access their existing Visa account. The integration of Visa Checkout, tied to an immersive 360-video experience and offering the opportunity to explore merchandise in a virtual store, means consumers can execute a secure, frictionless payment in the VR experience without having to remove their VR headset. Via uploadvr.com