It’s the end of the week and time for an e-commerce and payments news roundup from around the globe. What a busy week it’s been in the payments industry as you’ll see in this list of stories.

Visa Rises on International Success

For the quarter, net revenue grew to $5.1 billion, a 13% increase year over year, and adjusted earnings per share rose to $1.11, a whopping 30% increase year over year. This strong top- and bottom-line growth was powered by 11% in payment volume growth, the amount of money travelling over Visa’s network, and a 12% increase in processed transactions, the number of times a Visa account is used to facilitate a transaction. (via The Motley Fool)

Corporate treasurers pushing for fintech collaboration

Stephen Darnley, corporate treasurer for International Air Transport Association (IATA), explains he is not concerned with the use of fintechs by banks, preferring to see a collaboration with a bank than to go to a fintech directly. “We do not want to work directly with fintechs, but with the banks in partnership it becomes a different question,” he says. “Having that bank involvement validates which fintechs to work with. (via Euromoney)

Amazon.com is going all-in on Amazon Pay

Amazon is reportedly offering discounts to merchants who use its in-house payments processing service, Amazon Pay. Analysts say Amazon appears to be taking a familiar approach to disrupting the payments industry by sacrificing profits in an effort to gain market share from Paypal and other payments leaders. Amazon Pay currently has about 30 million users, which can use the service to make purchases online. (via US & World Report News)

Supplier Payments Around the World Are Getting Longer, Raising Insolvency Risk

Regulators and analysts in the UK have brought attention to the nation’s plight against late supplier payments, but a new report from Euler Hermes warns this is a global issue — one that is worsening and raising the insolvency risk. (via PYMNTS.com)

Regulators and analysts in the UK have brought attention to the nation’s plight against late supplier payments, but a new report from Euler Hermes warns this is a global issue — one that is worsening and raising the insolvency risk. (via PYMNTS.com)

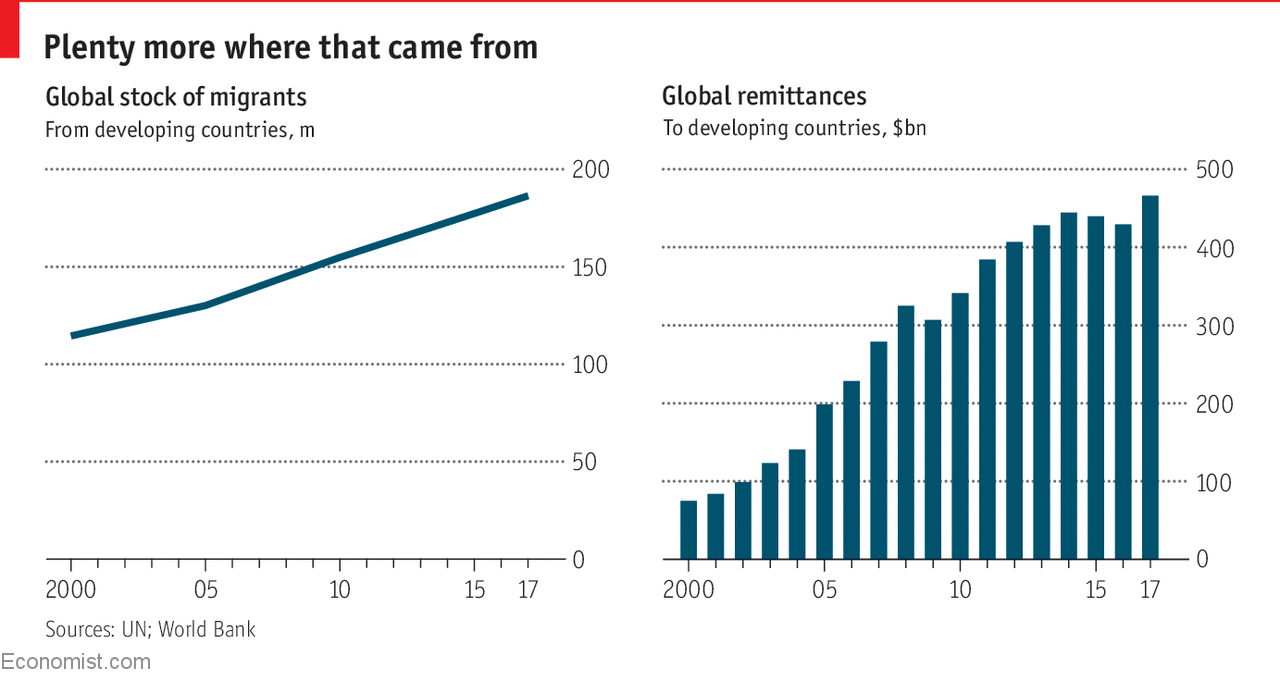

The battle for the remittances market: Cheaper cross-border transfers are coming

In March Swift, a Brussels-based service owned by 11,000 banks that handles more than half of all cross-border interbank payments, said further progress was needed before distributed-ledger technology “will be ready to support production-grade applications in large-scale, mission-critical global infrastructures”. But it is coming, and cross-border payments are in its sights. (via The Economist)

$34 billion annual hole identified in global freight payment systems

A new white paper from consultants Drewry suggests that today’s antiquated liner invoicing and payment processes are costing the industry $34.4bn annually. Among shippers and forwarders, the level of automation of invoice reconciliation and settlement is “very low”, Drewry stated, particularly among small and medium size players. (via Splash247.com)

A new white paper from consultants Drewry suggests that today’s antiquated liner invoicing and payment processes are costing the industry $34.4bn annually. Among shippers and forwarders, the level of automation of invoice reconciliation and settlement is “very low”, Drewry stated, particularly among small and medium size players. (via Splash247.com)

Killing Cash? Why Digital Payments, Bitcoin Can’t Finish The Job. Yet.

The global payments infrastructure is experiencing massive digital upheaval. Mobile and proximity payments are quickly entering the mainstream. Bitcoin has a market cap that could make a blue chip blush, and new retail concepts like Amazon Go and Shake Shack’s cashless store bring momentum to the theory that cash could essentially become useless in a future retail environment. (via retailtouchpoints.com)

The global payments infrastructure is experiencing massive digital upheaval. Mobile and proximity payments are quickly entering the mainstream. Bitcoin has a market cap that could make a blue chip blush, and new retail concepts like Amazon Go and Shake Shack’s cashless store bring momentum to the theory that cash could essentially become useless in a future retail environment. (via retailtouchpoints.com)

Instagram quietly launches payments for commerce

Get ready to shop the ‘Gram. Instagram just stealthily added a native payments feature to its app for some users. It lets you register a debit or credit card as part of a profile, set up a security pin, then start buying things without ever leaving Instagram. Not having to leave for a separate website. (via Techcrunch)

Get ready to shop the ‘Gram. Instagram just stealthily added a native payments feature to its app for some users. It lets you register a debit or credit card as part of a profile, set up a security pin, then start buying things without ever leaving Instagram. Not having to leave for a separate website. (via Techcrunch)

Mastercard Sets the Pace in Biometric Payment Cards Race

Mastercard took a big step forward in payment card technology this week with its announcement of a remote enrolment solution for biometrics. Developed in partnership with biometrics specialist IDEX, the system is designed to let cardholder register their fingerprints remotely, without the need to go into a bank. That means those who take advantage of Mastercard’s biometric payment cards – when they become available – won’t need to make any special effort to activate them, at least not much beyond what’s normally required for a new credit card. (via FindBiometrics)

Mastercard took a big step forward in payment card technology this week with its announcement of a remote enrolment solution for biometrics. Developed in partnership with biometrics specialist IDEX, the system is designed to let cardholder register their fingerprints remotely, without the need to go into a bank. That means those who take advantage of Mastercard’s biometric payment cards – when they become available – won’t need to make any special effort to activate them, at least not much beyond what’s normally required for a new credit card. (via FindBiometrics)

JP Morgan Files Patent for Blockchain-Powered P2P Payments Between Banks

JP Morgan Chase & Co has filed a patent for a P2P network that would use a blockchain to process payments between banks in real-time. JP Morgan Chase & Co. has outlined a peer-to-peer payments network in a patent application filed with the US Patent and Trademark Office (USPTO). (via Cointelegraph)

JP Morgan Chase & Co has filed a patent for a P2P network that would use a blockchain to process payments between banks in real-time. JP Morgan Chase & Co. has outlined a peer-to-peer payments network in a patent application filed with the US Patent and Trademark Office (USPTO). (via Cointelegraph)

Enjoy this collection of global e-commerce and payments industry news and have a relaxing spring weekend.

LET’S CONNECT