Just in time for your weekend leisurely reading, we’ve got a global e-commerce and mobile payments news roundup. E-commerce highlights include Amazon Pay‘s new India investments, a profile of Tencent founder Pony Ma, tips on cross-border business from Braintree and a report from RBR on global credit card payments growth.

On the mobile payments front, we’ve got stories on instant mobile payments in Japan using Ripple, Hong Kong mobile payments preferences, mobile payments myths in China, UK Co-op in-aisle payments test and whether mobile order ahead/payments in restaurants is stalling.

Global e-commerce news

Amazon Fuels Digital Payments Arm Amazon Pay With $30 Million Funding

Amazon Pay, the digital payments arm of e-commerce giant Amazon, has reportedly raised $30 million from its parent entity. The development comes just over five months after Amazon Pay India received a capital infusion of $40 million. The latest capital infusion came from Singapore-based Amazon Corporate Holdings Pvt Ltd and the US-based parent Amazon.com. Via inc42.com

Amazon Pay, the digital payments arm of e-commerce giant Amazon, has reportedly raised $30 million from its parent entity. The development comes just over five months after Amazon Pay India received a capital infusion of $40 million. The latest capital infusion came from Singapore-based Amazon Corporate Holdings Pvt Ltd and the US-based parent Amazon.com. Via inc42.com

China: the global e-commerce giant

With a fortune of 295 billion yuan (US$46.6 billion), Ma Huateng, founder and CEO of Internet giant Tencent, is now the wealthiest person in China. The business leader, also known as Pony Ma, has jumped 23 places to be ranked 15th globally, according to the Hurun Global Rich List 2018 released last Wednesday. Behind the rise of Ma and his company is China’s flourishing digital economy, which has been a story of commercial success. China’s digital economy totalled 26 trillion yuan ($4.1 trillion) in 2017. Via www.shine.cn

With a fortune of 295 billion yuan (US$46.6 billion), Ma Huateng, founder and CEO of Internet giant Tencent, is now the wealthiest person in China. The business leader, also known as Pony Ma, has jumped 23 places to be ranked 15th globally, according to the Hurun Global Rich List 2018 released last Wednesday. Behind the rise of Ma and his company is China’s flourishing digital economy, which has been a story of commercial success. China’s digital economy totalled 26 trillion yuan ($4.1 trillion) in 2017. Via www.shine.cn

How Top X-Border Performers Win the Global Game

Albert Drouart, director, international at Braintree isn’t going to pretend the task is easy – but, he said, it’s a lot easier than most merchants think. “I’m always dismayed by the unnecessary complexity,” Drouart remarked in a recent discussion with Karen Webster. “Merchants see a bigger challenge than it actually is. I always tell them, ‘You can get started! You have the data to start selling in other countries.’ They don’t need to get an entity to start selling their goods across borders.” Via pymnts.com

Albert Drouart, director, international at Braintree isn’t going to pretend the task is easy – but, he said, it’s a lot easier than most merchants think. “I’m always dismayed by the unnecessary complexity,” Drouart remarked in a recent discussion with Karen Webster. “Merchants see a bigger challenge than it actually is. I always tell them, ‘You can get started! You have the data to start selling in other countries.’ They don’t need to get an entity to start selling their goods across borders.” Via pymnts.com

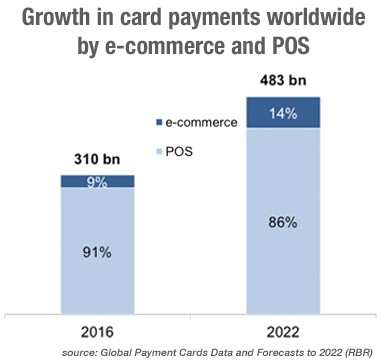

Online card payments to double by 2022

The number of card payments made online worldwide is set to jump from 29 billion in 2016 to 70 billion in 2022, according to Global Payment Cards Data and Forecasts to 2022, a report by research firm RBR. RBR analysis shows a 28% increase in e-commerce card payments worldwide from 2015 to 2016, and that these payments represented 9% of all card transactions. RBR forecasts that by 2022, 14% of all card payments will be made online. Via atmmarketplace.com

The number of card payments made online worldwide is set to jump from 29 billion in 2016 to 70 billion in 2022, according to Global Payment Cards Data and Forecasts to 2022, a report by research firm RBR. RBR analysis shows a 28% increase in e-commerce card payments worldwide from 2015 to 2016, and that these payments represented 9% of all card transactions. RBR forecasts that by 2022, 14% of all card payments will be made online. Via atmmarketplace.com

Mobile payments news

Consortium of 61 Japanese Banks to Release Instant Mobile Payments Using Ripple

The Japanese Bank Consortium will release an instant domestic payments mobile app, “MoneyTap,” using Ripple’s technology in the fall of 2018, Ripple’s blog reported yesterday, March 6. The 61-bank consortium, led by SBI Ripple Asia, represents more than 80% of all of Japan’s banking assets, according to Ripple. Via cointelegraph.com

The Japanese Bank Consortium will release an instant domestic payments mobile app, “MoneyTap,” using Ripple’s technology in the fall of 2018, Ripple’s blog reported yesterday, March 6. The 61-bank consortium, led by SBI Ripple Asia, represents more than 80% of all of Japan’s banking assets, according to Ripple. Via cointelegraph.com

When it comes to mobile wallets Hongkongers love WeChat Pay, but prefer using Apple Pay

Rise of mobile payments in China: Myths and facts

An article about why mobile payment is so popular in China has gone viral. The article, written by a Taiwanese manager working on the mainland, has however made many wrong conclusions. Lack of ATMs is actually not the reason for the popularity of mobile payment. The real reason is the ease of mobile payment, which makes ATMs unnecessary. Via ejinsight.com

An article about why mobile payment is so popular in China has gone viral. The article, written by a Taiwanese manager working on the mainland, has however made many wrong conclusions. Lack of ATMs is actually not the reason for the popularity of mobile payment. The real reason is the ease of mobile payment, which makes ATMs unnecessary. Via ejinsight.com

Co-op partners Mastercard to trial in-aisle mobile payments

Shoppers at UK supermarket the Co-op will soon be able to bypass the checkout and instead pay for their groceries with their own mobile phones. The Co-op has teamed up with Mastercard to trial a new app at the retailer’s support centre in Manchester ahead of a wider rollout this summer. Customers will be able to scan products as they walk around the store. When they have finished shopping, the amount they owe will be deducted from their account with a single click, using Mastercard Masterpass. Via finextra.com

Shoppers at UK supermarket the Co-op will soon be able to bypass the checkout and instead pay for their groceries with their own mobile phones. The Co-op has teamed up with Mastercard to trial a new app at the retailer’s support centre in Manchester ahead of a wider rollout this summer. Customers will be able to scan products as they walk around the store. When they have finished shopping, the amount they owe will be deducted from their account with a single click, using Mastercard Masterpass. Via finextra.com

Are Diners Finding Mobile Payments Options Unappealing?

We’ve been following developments in mobile order-ahead / mobile payments options for restaurants here for some time, owing largely to their ability to speed up a dining experience and get some of the unpleasant parts of it out-of-the-way faster, like waiting for someone to actually bring a bill to your table. New reports, however, suggest that mobile order and pay options aren’t being put to use very often, even where available. Via paymentweek.com

We’ve been following developments in mobile order-ahead / mobile payments options for restaurants here for some time, owing largely to their ability to speed up a dining experience and get some of the unpleasant parts of it out-of-the-way faster, like waiting for someone to actually bring a bill to your table. New reports, however, suggest that mobile order and pay options aren’t being put to use very often, even where available. Via paymentweek.com

Enjoy your weekend and keep your payments positive.

LET’S CONNECT