By Jeff Domansky, May 21, 2021

Frustrated with 15 months of pandemic restrictions, work-from-home mandates, and longing to shop in-store once again, consumers appear ready to reopen their purses and wallets with a vengeance.

Earlier this spring, Bloomberg Economics estimated Americans have a stockpile of savings approaching $1.7 trillion. With new stimulus payments in hand, retailers anticipate a perfect storm of revenge-retail and revenge-travel spending. And, by God, consumers seem ready to binge.

The pandemic pushed digital adoption and contactless payments three years faster than industry expectations. So, where will these revenge shoppers spend, and how will they pay for it? We’ve got some answers from a new Global Digital Payments Insights report from Blackhawk Network.

Government stimulus plan got economy started

“This round of stimulus is coming at the same time that the economy is properly reopening,” said Michelle Meyer, head of US economics at Bank of America Corp. “If you have a lot in your bank account already, you don’t have very much debt to pay off; you probably do feel more comfortable spending the stimulus check.”

Meyer said consumers forced into saving because of social distancing and pandemic restrictions seem likely to start spending as the health crisis subsides and herd immunity is reached.

The stimulus seems to have primed the economic pump.

US retail ready to rumble

The National Retail Federation (NRF) agrees consumers seem ready to spend. “Year-over-year growth of 28.8% demonstrates that household finances remain strong, and the economic recovery will likely continue to gain steam as we head into the summer months,” said Matthew Shay, NRF President, and CEO.

“Consumers are demonstrating that when they feel safe, they are both willing and able to spend and are driving the economy forward. The CDC’s updated guidance for fully vaccinated individuals will help further open the economy and get more people back to work,” he said.

While US April 2021 retail sales were slightly softer from record March spending, down 1.3%, they soared 52.1% over April 2020.

“The economy and consumer spending have proven to be much more resilient than many feared a year ago,” NRF Chief Economist Jack Kleinhenz said. “Today’s year-over-year numbers are off the charts in some categories, reflecting the disparity between retailers that could remain open a year ago and those that were forced to shut down. Consumers may have tapped the brakes slightly in April compared with March, but it was like going from 100 mph to 85 mph compared with last year.”

The NRF said April retail sales increased across the board year-over-year, led by massive increases in retailers like clothing (up 711.3%), furniture (+199.2%), sporting goods (+155%), electronics/appliances (+139.9%), building materials/garden supplies (+32.9%), health/personal care (+24.6%), online/other stores (+14.8%), and general merchandise (+13.6%).

Shoppers discovered online convenience

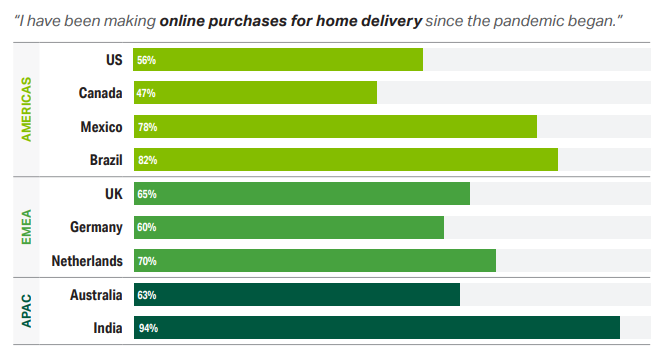

In each of the nine countries, the pandemic forced consumers to find what they needed online according to the Blackhawk Network report.

“In 2020, more than two billion people worldwide purchased goods or services online and online retail sales surpassed $4.2 trillion. E-commerce website traffic recorded 22 billion monthly visits around the world during that same time. Mobile online shopping is the main driver of this shift, but digital wallet adoption is another significant factor,” the report noted.

Shoppers not only found what they needed online, shopping frequency surged at online-only retailers. Consumers in most countries surveyed shopped more frequently at these merchants and they will continue these shopping habits in the future.

Consumers locked and loaded with (digital) cash

In its survey of more than 13,000 global consumers, Blackhawk Network found shoppers in every region seem to have found digital religion and a strong connection with retailers that offer more digital payment methods.

“Shoppers continue to look for easier ways to tap into mobile wallets, digital gift cards, rewards, and loyalty points, and as a result, are increasingly seeking retailers that have embraced digital and contactless payments,” said Theresa McEndree, global head of marketing, Blackhawk Network.

“Our research shows that consumers around the world are drawn to retailers that offer fast, seamless, and secure digital payments. As we start to hit more of a stride in our economic recovery, the winners will be the merchants that cater to the everyday digital payment preferences of today’s shopper,” McEndree added.

How will consumers pay today and in the future?

Blackhawk Network’s research identified key payment trends critical for retailers and other business:

- e-commerce surge connected shoppers with retailers offering digital payments: 69% said they would shop more frequently, 54% will spend more, and 85% said digital payments make shopping easier

- QR codes were the newest, most-used digital tool: 18% used mobile phone QR or barcodes for the first time; 40% use them more frequently; 30% of nonusers said they were interested in using digital barcodes or QR codes

- gift cards grew in popularity: 34% purchased a physical or digital gift card for themselves in the past year, and 46% are interested; nearly half used digital cards at online-only stores.

Hurdles to digital payment adoption remain

Despite growth in digital payments use and acceptance, roadblocks remain according to the Blackhawk Network report:

- 50% of digital wallet users reported friction because they’re not accepted everywhere

- 30% found they couldn’t always use the same digital wallet everywhere; 73% want to pay the same way in-store and online

- 27% said there were too many digital wallet options

- 20% said they still don’t feel comfortable using digital wallets compared with traditional payments.

Consumers want more secure payments (46%), easier payments (39%), and faster payments (37%). Payments industry and retailers, are you listening?

In-store shopping ready for revival

Encouragingly for bricks-and-mortar retailers, Blackhawk Network research shows 55% of in-store shoppers are ready to return to shopping centers compared to 53% who will continue shopping online or using at-home delivery.

51% of customers said they missed being able to see and touch products before purchasing.

Researchers surveyed more than 13,000 consumers in the US, Australia, Brazil, Canada, Germany, India, Mexico, Netherlands, and the UK, representing nearly half of the world’s card payment volume.

For more global insights and in-depth analysis, download Blackhawk Network’s “Payments EQ: Connecting Globally Through Digital Payments” report free here.

Related PaymentsNEXT coverage:

Consumer buying behaviors that will shape the future of retail

New research: Luggage packed, business travelers raring to go

Changes brewing for retailers at point-of-sale