Chatbots, robo-services, AI and other disruptive technologies are starting to appear in banking, retail, customer service and even investment services. Today, we look at companies using or exploring the possibility of robo-services to enhance customer service, deliver innovative services or products, and increase business efficiency, reach, and marketing of banking, financial and payment services.

Techfoliance profiles five best, new banking chat it’s including Personetics Anywhere, Plum, Finn.ai, Ernest and Abe. Henri Arslanian says industry leaders need to watch out for RegTech, chatbots and the Indian market in 2017. What’s RegTech? Deloitte defines it as: technology that seeks to provide “nimble, configurable, easy to integrate, reliable, secure and cost-effective” regulatory solutions.

PYMNTS.com profiles the best chatbots of 2016 and predicts 2017 will be the “year of the chatbot.” Lexology highlights the hot topics from the 2016 Money20/20 conference including chatbots, open data and “sandboxes.” Recent banking chatbots launched included Russian chatbot TalkBank, MasterCard’s Kai, Bank of America’s Erica and Kasisto/Varo Money’s Val.

PYMNTS.com profiles the best chatbots of 2016 and predicts 2017 will be the “year of the chatbot.” Lexology highlights the hot topics from the 2016 Money20/20 conference including chatbots, open data and “sandboxes.” Recent banking chatbots launched included Russian chatbot TalkBank, MasterCard’s Kai, Bank of America’s Erica and Kasisto/Varo Money’s Val.

Chris Gledhill, CEO of Secco predicts bank bots will eventually disappear as consumers use more integrated or cross-platform apps like Apple’s Siri, Amazon’s Alexa, Google Now or those on the horizon from Facebook, WeChat and Snapchat.

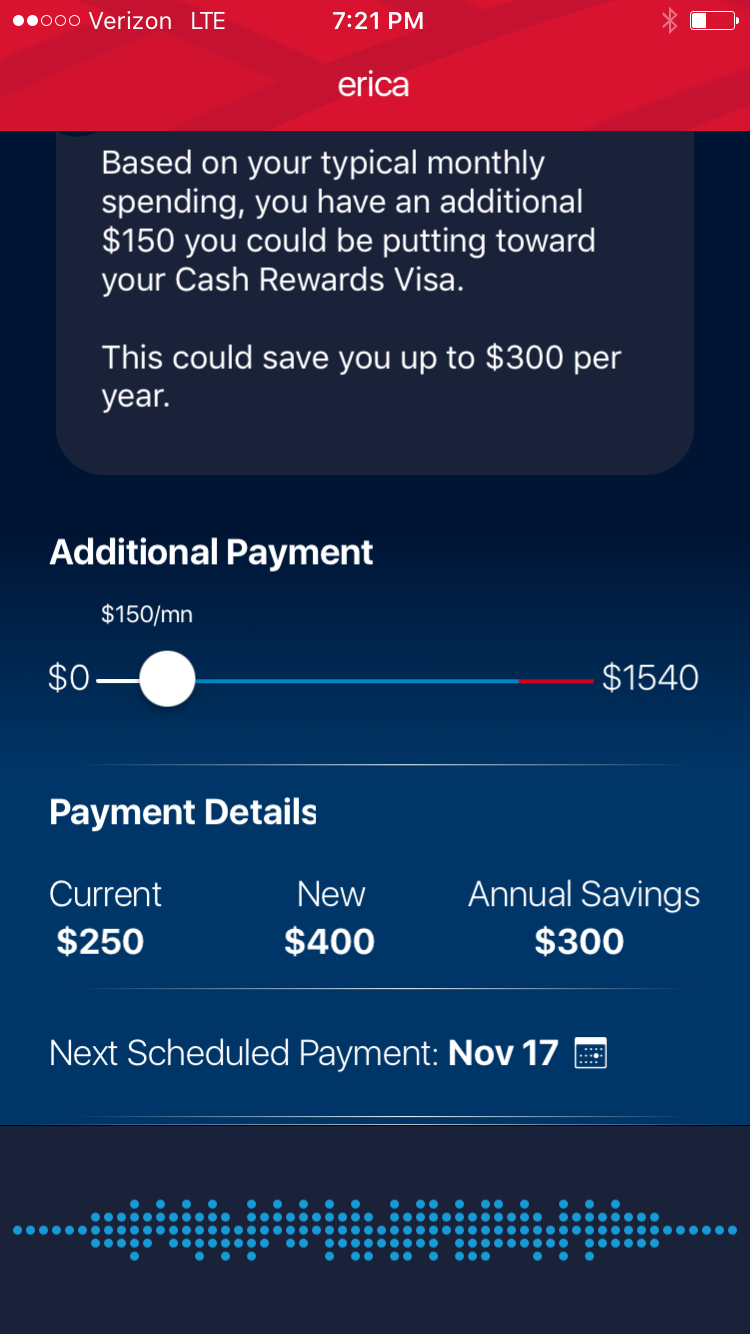

In October, Bank of America launched its new AI virtual assistant called Erica. India’s HDFC Bank and Niki.ai launched a banking chatbot for bank customers and non-customers on Facebook Messenger. It allows bank transactions as well an e-commerce gateway for simple transactions like ordering food, booking a taxi or paying bills. Charles Schwab plans to launch Schwab Intelligent Advisory which connects clients with investment advisors and robo-advisory services.

Robo-advisors will be a hot topic in 2017 as the financial services industry wrestles with how to develop, integrate, manage and support new artificial intelligence-based services. Uday Singh, partner at AT Kearney, warns low-fee or no-fee robo-advisors may not be sustainable. Fiona Tait at Royal London Group says robo-advisors will show clients how challenging financial advice is.

5 Chatbots you must know in the Banking sector

Could Chatbots have the same effects on mobile apps than Blockchain on the internet? The question is still hard to answer as we are still in the early days of Artificial Intelligence applied to bots.

Could Chatbots have the same effects on mobile apps than Blockchain on the internet? The question is still hard to answer as we are still in the early days of Artificial Intelligence applied to bots.

However, one thing we know is that for the ‘first time ever people are using messengers apps more than they are using social networks‘ according to the media Chatbots Magazine. In a recent post, Christine Duhaime, founder of The Digital Finance Institute and Fintech influencer based in Canada, showed how big the opportunity was by pointing out the 2.5 billion people around the world that were now using daily messaging apps such as Facebook Messenger or WeChat.

Because the number of people using chatbots is expected to reach 2.2 billion by 2020, we thought that it would be interesting to highlight 5 chatbots that illustrate the potential of these technologies for financial services: Via techfoliance.fr

Watch out for RegTech, Chatbots and India in 2017, says PwC’s FinTech and RegTech leader

As we move closer to welcome 2017, Henri Arslanian, PwC’s newly appointed FinTech and RegTech Leader for China & Hong Kong, has put forward some predictions for financial technology (FinTech) in Asia. “2016 was the year FinTech went mainstream,” says Arslanian. “So what can we expect for 2017? Here are some of my predictions for FinTech in Asia”.

As we move closer to welcome 2017, Henri Arslanian, PwC’s newly appointed FinTech and RegTech Leader for China & Hong Kong, has put forward some predictions for financial technology (FinTech) in Asia. “2016 was the year FinTech went mainstream,” says Arslanian. “So what can we expect for 2017? Here are some of my predictions for FinTech in Asia”.

Arslanian believes China to be a global leader in many aspects of B2C FinTech and expects its role in fintech innovation to get the global recognition and respect it deserves in 2017.

“This [FinTech] industry has grown so much in recent years that nobody can really claim to be a ‘FinTech specialist’. Each of the many verticals of FinTech, from P2P and payments to robo-advisory and blockchain, have become disciplines in their own right”, he said. “This trend will continue in 2017, as the FinTech industry matures and related disciplines such as RegTech and InsurTech increase their dedicated following.” Via econotimes.com

What is Regtech? And Why is it Becoming the Next Big Thing?

Heralded “the new FinTech” by Deloitte, “RegTech” has rapidly risen to prominence in 2015, from total obscurity. But what is Regulatory Technology (RegTech) tech exactly? And why is it becoming the next big thing?

Heralded “the new FinTech” by Deloitte, “RegTech” has rapidly risen to prominence in 2015, from total obscurity. But what is Regulatory Technology (RegTech) tech exactly? And why is it becoming the next big thing?

At risk of sounding too simple, RegTech is pretty much what is says on the tin: the use of new technology to facilitate the delivery of regulatory requirements. Or, in more words, RegTech is technology that seeks to provide “nimble, configurable, easy to integrate, reliable, secure and cost-effective” regulatory solutions (Deloitte).

Is RegTech the new Fintech?

In itself, this marriage of regulation and technology is not new. But it is becoming more and more crucial as levels of regulation rise and focus on data and reporting increases. It is also addressing a gap in a market (financial services) that is being disrupted at a speedy pace by FinTech. In a range of areas, dynamic FinTech has been driving a more efficient and more effective way of doing things. The extension of this disruption to regulatory practice is the next logical step. Via complyadvantage.com

Chatbot Tracker: The Best Bots of the Year

Chatbots have had quite the year. Bots can order a personal pizza, book a flight to anywhere, stir up a cocktail recipe, ship last-minute holiday gifts, memorialize dead relatives and bring back infamous “Friends” characters, register voters to vote or get a new driver’s license and help check your bank account. They can even incite a giggle during the conversation.

Chatbots have had quite the year. Bots can order a personal pizza, book a flight to anywhere, stir up a cocktail recipe, ship last-minute holiday gifts, memorialize dead relatives and bring back infamous “Friends” characters, register voters to vote or get a new driver’s license and help check your bank account. They can even incite a giggle during the conversation.

But some bots don’t always do so well. Most recently, Microsoft is crossing its fingers for its newly added Zo (after the Tay debacle), and Yahoo plucked Radar, its travel bot, from circulation.

“Yahoo’s decision to eliminate its travel assistant bot speaks more to their overall business concerns at this time than the market for chatbots,” said David Horton, managing director of innovation at Synechron. “As they deal with the aftermath of their recent hacks and the uncertainty of their acquisition by Verizon going through, it would be difficult to successfully roll out a new offering.”

Horton said that, as a whole, the market is ready for this type of technology, and many financial and tech firms, service companies and consumers are already using it. In fact, some experts said 2017 will be the “Year of the Chatbot,” and yet, others aren’t too sure. Reason being, 2016 was such a great year for chatbots. Via pymnts.com

Chatbots, Open Data and Sandboxes: Trending Topics from the 2016 Money20/20 Conference

With 10,000+ attendees, including more than three thousand companies from seventy-five countries, Money20/20 is the largest annual global event focusing on payments and financial services innovation.

With 10,000+ attendees, including more than three thousand companies from seventy-five countries, Money20/20 is the largest annual global event focusing on payments and financial services innovation.

The 2016 conference in Las Vegas this October featured a packed agenda of talks by industry and thought leaders on a broad range of current and emerging Fintech issues, as well as an exhibition area featuring Fintech companies, investors, incubators, venture capitalists, consultants, regulators and lawyers. A team of McCarthy lawyers attended again this year and report back on some of the hottest topics of the 2016 conference: machine learning and artificial intelligence (AI), open data and regulatory sandboxes/ innovation hubs. Via lexology.com

Banking Chatbot Launched By Kasisto, Varo Money

More banking bots are popping up each week. Russian chatbot TalkBank launched last week, and back in November, at Money20/20, Mastercard launched its KAI chatbot and Bank of America launched Erica.

More banking bots are popping up each week. Russian chatbot TalkBank launched last week, and back in November, at Money20/20, Mastercard launched its KAI chatbot and Bank of America launched Erica.

Now, a new banking app named Val has been introduced to the world. The bot is brought by Kasisto, a company focused on transforming consumer banking through artificial intelligence (AI), and mobile banking startup Varo Money. The partnership announced that it intends to power Val through Varo’s mobile app.

Val, which is considered “a digital money coach” is still in beta form, with plans to fully launch in early 2017. The bot will provide an integrated approach to deposits, savings and lending. Ultimately, the plan for the partnership is to help improve a consumer’s financial health through better spending, saving and borrowing. Personalizing insights will also be provided and available at consumers’ fingertips.

The companies said that, because research says millennials check their phones more than 45 times a day, the banking platform is meeting those customers where they are: on their phones Via pymnts.com

FinTech Chatbots – The Millennial Command Line

In my role as CEO of Secco I’ve been thinking a lot of thought about future banking interfaces. Banks have churned through a good few channels recently: Mail, Branch, ATM, SMS, Telephony, Web, Mobile App. Most big banks are still juggling all these channels but it’s fair to say the Mobile App currently rules supreme. Mobile apps went mainstream in 2008 when the iPhone App Store opened up to 3rd party apps, however it wasn’t until about 2011 that banking apps started to appear and it took another 5 years for them to gain mass-adoption. Banks are now feeling rather smug about their apps, blissfully unaware the wind is about to change on customer UX.

In my role as CEO of Secco I’ve been thinking a lot of thought about future banking interfaces. Banks have churned through a good few channels recently: Mail, Branch, ATM, SMS, Telephony, Web, Mobile App. Most big banks are still juggling all these channels but it’s fair to say the Mobile App currently rules supreme. Mobile apps went mainstream in 2008 when the iPhone App Store opened up to 3rd party apps, however it wasn’t until about 2011 that banking apps started to appear and it took another 5 years for them to gain mass-adoption. Banks are now feeling rather smug about their apps, blissfully unaware the wind is about to change on customer UX.

There are a few contenders for the next bank channel of choice. There’s been a lot written this year about Pokemon Go and the prospect of mainstream Augmented Reality interfaces and the Internet of Virtual Things (IoVT) and that is a very real prospect but likely the next #1 customer touchpoint for the majority of incumbent banks will be chatbots. These will take the form of existing social chat channels (WeChat, Facebook Messenger, WhatsApp, SnapChat, etc) or OS-level smart assistants (Apple Siri, Google Now, Amazon Alex etc). Banks and other industry vertical players will toy with their own chatbots but they will ultimately fail as the best bots will be multi-disciplined.

This is not the end of the app-age. The way I see it there are transactional apps and experience apps. Transactional apps (order pizza, pay a bill, call a cab, look up train time etc) will be consumed by chatbots over the next few years as bots mature. Experience apps (games, entertainment, education etc) will last longer until AR/VR take them out. I guess the bad news for incumbent banks is they tend to fall in the transactional camp. Their way out, assuming they still want to ‘own the customer’, is to either become an experience app (not easy but it’s something we’re trying) or to go bot-free and play towards to sizeable segment of customers who will find chatbots as frustrating to deal with as telephony. Via finextra.com

Bank of America launches AI chatbot Erica — here’s what it does

Monday at the Money 20/20 conference, Bank of America’s president of retail banking, Thong Nguyen, unveiled an artificially intelligent bot to help customers make smarter decisions.

Monday at the Money 20/20 conference, Bank of America’s president of retail banking, Thong Nguyen, unveiled an artificially intelligent bot to help customers make smarter decisions.

The new digital assistant “Erica” — a play on the bank’s name — will be available inside the bank’s mobile app staring next year. Customers can chat with Erica via voice or text message.

With Erica, the company hopes to help consumers create better money habits, said Michelle Moore, Bank of America’s head of digital banking. For example, Erica might send someone a predictive text: “Michelle, I found a great opportunity for you to reduce your debt and save you $300.” Via cnbc.com

HDFC Bank, Niki.ai tie up for chatbot banking

HDFC Bank has tied up with Niki.ai, the artificial intelligence firm funded by Ratan Tata & Ronnie Screwvala, to bring in ‘conversational banking’ — chatbots that facilitate commerce and banking transactions without getting out of the chat window.

HDFC Bank has tied up with Niki.ai, the artificial intelligence firm funded by Ratan Tata & Ronnie Screwvala, to bring in ‘conversational banking’ — chatbots that facilitate commerce and banking transactions without getting out of the chat window.

The chatbot is presently available on Facebook messenger where it can be used for e-commerce transactions like booking a cab, ordering food or paying bill. Speaking to TOI, Nitin Chugh, HDFC Bank’s digital banking head, said that the chatbot was designed to work as a virtual concierge service.

The HDFC Bank on-chat app is available to anyone and not just those with HDFC Bank accounts. “The chat opens a payment gateway through which transactions can be made using any bank account,” said Chugh. “In social media, the chatbot will facilitate e-commerce transactions. For instance, if you ask it to book a cab, the bot will get your location and look for cabs available with different aggregators,” said Chugh. Via timesofindia.indiatimes.com

Financial Advisor IQ – New Schwab Robo Ups Ante with Vanguard

Charles Schwab is planning on launching a hybrid online advice service to rival entrenched competitors like Vanguard and Personal Capital. But it’s hardly going to look like most other robos, the company says in a press release.

Charles Schwab is planning on launching a hybrid online advice service to rival entrenched competitors like Vanguard and Personal Capital. But it’s hardly going to look like most other robos, the company says in a press release.

Schwab Intelligent Advisory, expected to launch in the first half of next year, will pair a team of certified financial planners with an algorithm-driven portfolio management system. That’s much like current robo services that combine human intervention with computer-generated investment models.

But an important caveat comes with Schwab’s new offering: It’s aiming to provide CFPs with enough expertise to discuss more than just investment planning with clients. Via financialadvisoriq.com

Will low fees kill off robo advisers?

The entrance of another low-cost digital advice offering from Schwab demonstrates a peril for any provider trying to eke out a position in the digital wealth management market: offering advice cheaply isn’t going to be enough to stay competitive.

The entrance of another low-cost digital advice offering from Schwab demonstrates a peril for any provider trying to eke out a position in the digital wealth management market: offering advice cheaply isn’t going to be enough to stay competitive.

But the premise was flimsy to begin with, says Uday Singh, a partner at the financial institutions practice of AT Kearney. “There isn’t a no fee or low-cost model that is sustainable,” Singh says.

Research by his firm and others points to an unavoidable dilemma — every digital advice firm needs to grow continuously, and fast. Scale, however, requires spending money on marketing and client acquisition costs, which can run up the numbers. Via Financial Planning

Financial Advisor IQ – Be the Medicine or Perish Trying

With the largest wealth transfer on record poised to change the landscape as Baby Boomers retire and Millennials enter the workforce, advisors are scrambling to grapple with the generation gap that comes with multi-generational clients.

With the largest wealth transfer on record poised to change the landscape as Baby Boomers retire and Millennials enter the workforce, advisors are scrambling to grapple with the generation gap that comes with multi-generational clients.

Client interaction, expectations and competing with lower-cost offerings such as robos were top-of-mind issues advisors weighed in on.

“Advisors are in for a period of uncertainty,” says Daniel Rothman, director of Insight for the Financial Times. “The advisor of the future will have to reconfigure the business and see their jobs not just being about picking stocks and asset allocation.” Via financialadvisoriq.com

Royal London: robo services could prove value of advice

Royal London has said the rise of self-service, online investment services will make it clearer to the public what an adviser should be paid for.

Royal London has said the rise of self-service, online investment services will make it clearer to the public what an adviser should be paid for.

Fiona Tait, business development manager at Royal London Group was speaking at the Association of Professional Financial Advisers financial professionals’ forum. She was asked whether so-called robo-advice would slow the rate at which individuals transition from self-investment to seeking financial advice.

She said: ‘It will illustrate to people what the value of advice is because it will show people how difficult it is.’ Via citywire.co.uk

Finding PaymentsNEXT useful?

Feellike you’re going to need a playbook for disruption in the financial services and payments industries? Subscribe at the top of the page to get Monday-Wednesday-Friday morning news briefs just like this in your inbox. When you need to know about what’s next in payments, PaymentsNEXT has you covered.

LET’S CONNECT