If you were one of the fortunate 150 million or so US citizens to receive a $1200 COVID-19 Relief Check in April, you probably spent it paying bills according to research from payments platform PayNearMe.

The company tracked millions of payments made by consumers between March 1 and April 17 on its payments platform. The number of payments made rose dramatically, up 40% compared to historical volumes, and debit card and ACH payments jumped nearly 50% above expectations days after the stimulus program direct deposits began.

How did Americans pay?

While traditional payment methods, including digital payments, remained similar to normal, cash payments were surprisingly popular according to PayNearMe.

Automated Clearing House (ACH) payments remained at 90% of past volume, debit card payments were just above 80%, and cash payments stayed at 78% of past levels. Cash payments were relatively stable, enabling consumers without electronic options to make payments.

“Although some media have reported the pandemic will kill the use of cash, our data shows the opposite. A significant portion of the American population is unbanked and underbanked, and many of them need to pay their bills with cash. This crisis demonstrates once again the importance of allowing consumers to pay their bills using whatever form of tender is most convenient for them.” said Danny Shader, Founder and CEO of PayNearMe.

Where consumers spent their relief check?

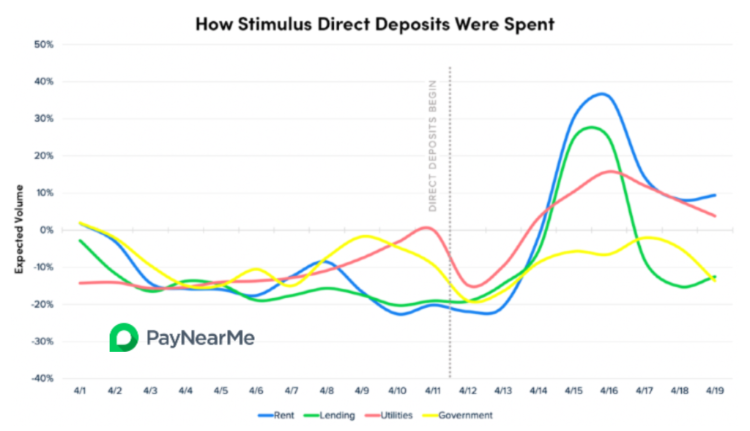

PayNearMe’s analysis of more than 300,000 transactions showed the biggest share of payments were for rent and the repayments of car and personal loans, with a small increase in utilities. Payments to the government (eg child support) remained slightly below expectations.

“Direct deposit stimulus checks had a clear impact on bill payments,” said Shader. “We’ll continue to monitor and report trends over the coming months.”

I guess with no way to travel to the Caribbean or Las Vegas, Americans chose to simply pay their bills and that’s a good thing.

The surprising resilience of cash

ACH and debit card payments on PayNearMe’s network skyrocketed to nearly 50% above expectations days after the stimulus program direct deposits began. “This matches our intuition, since electronic deposits in consumers’ bank accounts can be converted easily into electronic payments,” Shader said. “Interestingly, cash payments also saw a boost, leading us to believe that some consumers may have converted their direct deposits into cash.”

Shader expects the cash payments curve to continue to be more spread out as stimulus checks reach consumers who will cash them before paying their bills.

PayNearMe’s research on actual spending mirrors research early in April by Credible and IPX 1031 that showed consumers were planning to spend their stimulus money on groceries, savings, utility bills, rent or mortgage, and credit card debt.

If a new round of stimulus checks is released, were not so sure Americans will be quite so conscientious about paying bills instead of treating themselves to a trip or new laptop for future work at home. Here’s hoping they save it.

Additional coronavirus payments research insights are available from PayNearMe.

LET’S CONNECT