By Douglas Hall, Publisher, PaymentsNEXT

As if shopping cart abandonment, false credit card declines, and the pandemic aren’t causing enough problems for retailers and online sellers, chargebacks continue to be a pain in the profits.

In fact, Chargebacks.com estimates for every $100 in chargebacks, the true cost is $240 in wasted time, expensive fees, penalties, or additional losses of goods and services.

Chargebacks are now a $40 billion annual hit to merchant accounts and the bottom line of businesses. And the problem during the pandemic is getting even worse.

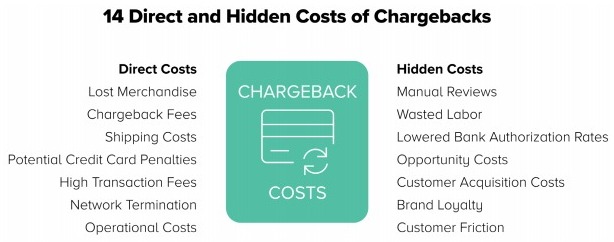

Direct costs hurt

The direct costs of chargebacks are well-known to most merchants. They include fees ranging from $10-$150 per order and credit card flat rate penalties from $10 to as high as $100,000. Reversal of transactions, lost product, cost of shipping and processing product returns and the rising cost of fraud monitoring, managing, and responding to chargebacks add to the direct costs.

Fraud protection firm Kount predicts that by 2022 the US will experience more than 33 million disputed transactions annually.

Worst of all is the potential for the merchant account to be terminated if the ratio of chargebacks to sales passes the risk level set by banks and credit card companies.

Kount says this can lead to unusual situations where a merchant might have large sales during the holiday season with correspondingly larger chargebacks which are applied to the following month, say January, when sales are much lower. The chargeback ratio is higher, resulting in increased fines and fees even though the “true” rate is not accurately reflected.

Research by Aite Group shows merchants end up paying 78% of the cost of chargebacks, so there’s no better reason to get proactive about reducing the number of chargebacks and lowering your direct costs.

Hidden costs impact even higher

The effort to reduce chargebacks can have an even bigger payback for merchants when it comes to hidden or indirect costs.

An October 2019 American Express Digital Payments Survey showed 27% of merchant transactions were fraudulent, up from 18% in 2018. In addition, 77% of merchants said they had been victims of fraud including stolen (37%) or counterfeit (33%) credit cards; card skimming (29%); employee fraud (36%); chargeback (36%) or return fraud (31%); and gift card fraud (32%). And 82% of merchants said they were vulnerable to mobile transaction fraud as well, up from 73% in 2018.

Now about those hidden costs? 69% of merchants agreed a significant amount of time and money is spent dealing with fraud.

Kount says the leading hidden costs of fraud can include manual reviews, wasted labor, reduced growth or loss of opportunity, higher bank authorization rates, increased acquisition costs, lost customer loyalty, and more consumer friction.

Coronavirus chargebacks grow

The global COVID-19 pandemic presents unique challenges for merchants as consumers shift to shopping more online. The influx of new online customers brings new challenges in fraud prevention, new account openings, KYC verification, staff to monitor fraud, along with a corresponding rise in chargebacks.

“Many new threats and business risks have developed in the last few weeks as a direct result of the shift in consumer behavior,” Monica Eaton-Cardone, COO of fraud prevention firm Chargebacks911 explained recently. “We’ve seen chargebacks based on service complaints overtake friendly fraud chargebacks, which typically represent between 60% to 80% of all issuances. Many of these chargebacks are being submitted by consumers who are new to e-commerce and may be impatient with crisis-related delays.”

She noted gaming sites saw a big increase in traffic and an 18.3% increase in chargeback disputes with the onset of the pandemic as people stayed home and worked from home. In an interview with Telemediaonline, she said “A similar pattern holds true for digital content which saw a 75% surge in transaction volume from March undercut by a 31% increase in chargebacks.”

Understandably, airlines also saw chargebacks increase 100% in the early stages of the pandemic. Eaton-Cardone said instances of “friendly fraud” could also be expected to grow as consumers face increased financial pressures.

Saying but not doing

There are several ironies in that digital payments survey by American Express. Merchants are saying they’re concerned about fraud but they’re not doing enough to prevent it because of cost, lack of tech-savvy, or difficulty in implementing fraud screening, monitoring, and prevention.

- 77% agree a one-time password for additional security to complete a purchase is effective in preventing fraud, yet only 33% do so.

- Three-quarters of merchants believe the measures to be effective, but only 30% or fewer use mobile device fingerprinting (31%), IP filtering (28%), or EMV 3-D Secure (27 %).

- 70% believe biometrics (76%) and tokenization (70%) are effective, yet only one-in-five use biometrics (21%) or tokenization (19%).

LexisNexis estimates merchants may be losing as much as $3.13 to every dollar in chargeback costs in a recent survey. No wonder fraudsters are having a field day every day!

Amazon enters fraud protection market

In the battle against fraud, there are many new developments on the horizon using artificial intelligence and other technology to monitor, predict, and mitigate fraud and reduce chargebacks.

Even Amazon has seen an opportunity in the business of fraud by today announcing the availability of Amazon Fraud Detector, a fully managed service that makes it easy to quickly identify potentially fraudulent online activities like online payment and identity fraud.

The service uses machine learning based on over 20 years of fraud detection expertise. On the Amazon Fraud Detector console, customers can select a pre-built machine learning model template, upload historical event data, and create decision logic to assign outcomes to the predictions (eg initiate a fraud investigation when the model predicts potentially fraudulent activity). Amazon Fraud Detector automatically identifies potentially fraudulent activity in milliseconds—with no machine learning expertise required.

Amazon says there are no up-front payments, long-term commitments, or infrastructure to manage with Amazon Fraud Detector, and customers pay only for their actual usage of the service. GoDaddy, Truevo, and ActiveCampaign are among the customers and partners already using the service to monitor and manage online fraud.

With the technology available today, there’s really no excuse for retailers and online sellers not to be more proactive in managing fraud and reducing the impact of chargebacks.

You can get a free copy of Kount’s Comprehensive Guide to Chargeback Prevention here.

Author: Douglas Hall is Publisher of PaymentsNEXT and a leading expert on the global payments industry.

LET’S CONNECT