The payday loans industry is rightly criticized for contributing to a vicious cycle of poverty from its outrageous payments practices and high interest rates for low-wage workers who need an occasional payday advance loan.

US payday loan companies typically charge $15 or more per $100 of payday loans, which works out to an APR rate of 391% for a typical two-week loan. Some payday lenders charge substantially more and failure to repay on time can add crippling debt quickly.

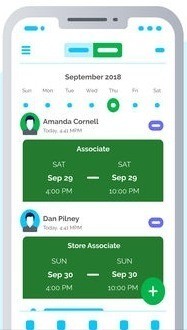

Minneapolis-headquartered Branch thinks it has a better, much less expensive solution for those living paycheck to paycheck with new payday advance features for its mobile app.

Pay lets hourly workers quickly sign up, forecast shift hours and receive a pay advance with a few simple clicks, followed by quick approval.

Low-cost payday advances fast

The Pay feature is simple to use and very inexpensive compared to traditional payday loans.

After completing a shift, workers have the option to withdraw an advance on their wages for that shift at no cost for three-day availability of their advance. For an optional $3.99 fee, workers can receive their advance immediately.

Once an employee gets paid, Branch withdraws the amount provided in advance along with the $3.99 instant delivery fee if used, from the employee’s bank account directly. Qualified users can withdraw up to $150 per day and up to $500 per pay period, based on the hours they’ve worked and consistent repayment of previous advances.

“We came to this new feature pretty organically after seeing user data on the dire need for cash flow: 70% of hourly employees had borrowed money from friends and family in the last three months and more than 75% were incurring hefty overdraft and late fees to help deal with unexpected expenses. We found that financial instability was a big part of their everyday lives and wanted to create a way to add greater scheduling and financial flexibility for hourly employees,” explained Branch CEO, Atif Siddiqi.

Until recently, Pay was only available to enterprises and select users from companies such as Dunkin’, Taco Bell, and Target. Pay is now accessible by individual app users across the US.

Smart pay advance features

Formerly a scheduling and company payments app, the new Pay features let workers forecast their own shifts and receive a short-term pay advance without the cost-prohibitive terms provided by traditional payday loan companies.

Included in the new Pay features are:

- Instant Access to Earnings: Real-time earnings technology allows qualified users to instantly advance up to $150 per day and up to $500 per pay period based on the hours they work

- Wage Tracker: Ability to forecast cash flow based on wages and scheduled shifts

- Shift Pick-up: Option to find and add more shifts to increase pay period earnings

- Overdraft Check: Pay won’t withdraw repayment if it will cause users to create an account overdraft.

“Opening Pay and instant access to earnings to all Branch users continues our mission of creating tools that empower the hourly employee and allow their work lives to meet the demands of their personal lives,” Siddiqi added. “Our initial users have embraced this feature, and we look forward to offering Pay to all of our organic users to better engage employees and scale staffing more efficiently.”

Initial Pay users average 5.5 transactions per month and more than 20% higher shift coverage than non-app users according to Branch.

Free and Enterprise plans available

The free app is now available for individual workers across the US. Branch Pay requires no integration with a company’s existing payroll system and customized enterprise plans and platforms can be quickly developed and easily implemented.

After downloading the IOS or Android app, users simply sign up on their mobile phone by entering their work location, debit card, and bank account information. Pay is supported by 98% of US banks and credit unions and is already being used by hundreds of thousands of US Fortune 1000 company employees.

Branch has partnered with New Jersey-based Cross River and financial technology platform Plaid to power payments and complete transactions.

Branch’s Pay feature is a great example of innovation and disruption, and traditional payday loans companies should be very nervous about the potential impact on their business by this agile fintech service provider. More information on Pay is available at the Branch website.

Visuals courtesy of Branch