By Jeff Domansky

If there was ever any doubt that buy now, pay later was mainstream worldwide, we can put that notion to bed once and for all.

The BNPL news in the past several days alone saw Visa unroll BNPL for merchants in Canada, PayPal target Australian merchants with the same, and Apple ready to roll out ‘Apple Pay Later’ soon with Apple Card partner bank Goldman Sachs.

Now you can add Discover’s $30 million investment in US-based Sezzle into the heated, competitive BNPL mix. Discover and Sezzle plan to launch a new buy now, pay later service on the Discover card network.

Oh, and did we mention Klarna’s $160 million buyout of social shopping service Hero Towers Ltd earlier in July? How about the acquisition of Four Technologies by PROG Holdings and Vive Financial? Or Mastercard’s ownership of BNPL merchant service provider Vyze?

The takeaway from these new developments is clear. The world’s biggest payment players are paying close attention to BNPL and mapping out their future market positioning through partnerships and acquisitions. Expect more of the same on the horizon in both developed and developing markets.

Visa Installments available for Canadian merchants

The Canadian market appears a perfect place for Visa Installments to introduce BNPL in a new partnership with Global Payments and Canadian credit union group Bank Desjardins.

The new deal allows Canadian merchants to offer flexible payment options to credit cardholders via Visa Installments through Global Payments and Bank Desjardins.

Canadian adoption of installment payments grew much faster than the US, increasing 30% in the past year alone. Installment payments represent $1.4 trillion in global payments volume, according to the Euromonitor International 2020 Installment Sizing Report. Installments are growing in adoption 2.5 times faster than traditional credit card payments.

With Visa Installments, consumers can purchase and pay later using their existing credit cards. Some plans will be interest-free; others may have varied interest rates and fees depending on loan value, term, number of installments, product, merchant, credit, and other defined eligibility factors.

In June, Visa and Scotiabank announced the first planned introduction of installment payments in Canada.

PayPal puts BNPL on the barbie down under

PayPal Australia launched its popular ‘PayPal Pay in 4’ payments plan in the country where buy now pay later first took hold with consumers and helped launch more than a dozen now-public BNPL companies.

With over 9 million Australian customers, PayPal is in a perfect position to challenge market leader Afterpay and ASX-listed market leaders such as Zip and Splitit.

PayPal will charge merchants its standard 2.9% of the purchase plus a $0.22 transaction fee compared to Afterpay’s 3% to 6% of the purchase plus the same transaction fee.

PayPal will not charge late fees as company research showed more than half of consumers would not do business with a company charging high late fees. “We are launching with no late fees in Australia because we believe it’s the right thing to do for our customers and will deliver a better consumer experience. We are backing the strength of our systems to determine consumer suitability for PayPal Pay in 4, and we believe we have the right measures in place to support our no late fees approach,” said Andrew Toon, General Manager, Payments, PayPal Australia.

PayPal also reduced its minimum purchase to A$30 ($22.44) from A$50 will be available for purchases up to $1500. It plans to use credit checks to determine consumer eligibility for installment payments. PayPal’s no-interest, no late fees, and no sign-up fees should have strong appeal in the competitive Australian BNPL consumer market.

Apple polishes its pay-later plans

Not to be outdone, Bloomberg reported Apple’s plans to partner with Goldman Sachs to offer a new ‘Apple Pay Later’ service to consumers purchasing with Apple Pay.

Goldman Sachs would provide loans for the new service, although it would not require the use of the Apple credit card.

While not yet announced, purchases on an Apple device using Apple Pay would offer shoppers the option to pay four interest-free payments every two weeks or with interest charges for longer terms.

“Apple already offers monthly installments via the Apple Card for purchases of its own products, but this service would expand that technology to any Apple Pay transaction,” sources told Bloomberg.

It’s also reported that users will quickly sign up through the Apple Pay app by simply submitting a local ID. In addition, Apple’s digital wallet will enable easy payment management and customer communication, although features could be canceled or changed by the time the product launches.

With $50 billion in annual revenue from its services business, Apple Pay Later is a big business opportunity. Affirm charges interest rates up to 30%, and other competitors charge lower rates for longer-term installment payments.

Predictably, these announcements caused shares of Affirm to fall 10% on Tuesday’s news, while Afterpay sagged 9.6% in Sydney Wednesday and PayPal, and it just 0.6% lower.

Research shows big BNPL awareness and adoption growth

Analysts and researchers are tracking the awareness and increase in adoption of buy now pay later services by consumers.

In a survey of 2,005 online shoppers from March 25 to April 12, 2021, C+R Research found 51% of consumers surveyed used a BNPL service during the pandemic.

Consumers have a long list of BNPL providers to choose from. According to C+R, PayPal Credit leads the way as the most popular service among users (57%), followed by other services including Afterpay (29%), Affirm (28%), Klarna (23%), ZipPay (19%), QuadPay (15%), Uplift (13%), Perpay (11%), Sezzle (8%), and Splitit (6%).

C+R used Amazon’s Mechanical Turk service to survey online shoppers and identify BNPL user data, so there is a built-in bias towards online shopping by these younger, tech-savvy, educated users.

Among users surveyed, users said they are currently paying for an average of 3.8 items by installments. Overall, people said their total BNPL debt owed on average was $883.

19% said they used BNPL services monthly, followed by 22% every three months, 29% every six months, and 8% weekly. When shopping online, 12% used the service all the time, followed by most of the time (35%), half of the time (20%), some of the time (20%), and rarely or never (13%).

A cautionary note for BNPL

Buy now pay later services are not without some red flags.

C+R turned up some interesting additional perspectives from these installment payment users:

- Two in three online shoppers believe buy now, pay later financing is “financially risky”

- 59% say they’ve purchased an “unnecessary” item they otherwise couldn’t afford using BNPL

- 57% regretted making a BNPL purchase because it was too expensive

- 56% admit to falling behind on monthly payments, while nearly half anticipate missing a future payment over the next year.

One other insight that may explain why credit card issuers in big payment processors are paying attention. 38% of those surveyed said they expect BNPL to replace their credit cards in the future and 56% prefer buy now, pay later to credit cards for purchases.

A unique BNPL research perspective

A PYMNTS/Sezzle survey offers an interesting contrast to C+R from 7,024 US consumers.

PYMNTS compares BNPL attitudes for three personas it identifies as:

- the “worry-free” consumer: does not live paycheck to paycheck and has a strong FICO score and no barriers to credit card approval

- the “second-chance” consumer: 23% of US consumers who may have “blemishes on your credit profiles that hinder their ability to access credit easily” are motivated to improve their credit score, and 31% live paycheck to paycheck and struggle with monthly bills

- the “shut-out” consumer: excluded from conventional credit access with low income and 49% living paycheck to paycheck and struggling to pay bills; 25% experienced an unexpected financially stressful event; no credit access due to significantly damaged credit or lack of credit history; choose BNPL to access shopping not otherwise available.

This is a unique way to look at the buy now pay later consumer spectrum. The report notes, “Credit increase rejections are at a historic high (40% in February 2021 versus 25% in February 2020), and credit application rejections are as well (26% in February 2021 versus 9% in February 2020). Adding to these challenges is the fact that many consumers will no longer consider credit cards as a way to buy the things that they want.”

Many consumers are no longer interested in using credit cards and other payment methods to get what they need and want.

BNPL opening credit options for credit-challenged consumers

PYMNTS estimates 29 million adult consumers (14% of online shoppers) used BNPL services in the last 12 months. “PYMNTS’ research also found that second-chance and shut-out consumers were more likely to use BNPL (28% and 18%, respectively), as were consumers in financial distress (22%),” according to the report.

7.6 million consumers who have never used BNPL are interested in it. “Second-chance” consumers were far more likely (43%) to use installment payments compared to “worry-free” consumers.

“Second-chance (29%) and shut-out (25%) shoppers also chose BNPL as a way to raise their credit scores more often than worry-free consumers (15%),” the report said. Also, 65% of consumers who have used BNPL see it as a way to shop without overspending.

There’s no question BNPL provides increased access to credit for credit-challenged individuals. The research shows 63% of shut-out consumers and 59% of second-chance consumers want better credit scores for an emergency credit line. 51% of BNPL users said using the service raised their credit scores.

In addition, 46% of shut-out consumers said installments allow them to make purchases they could not otherwise afford. I’m not sure many credit-challenged consumers appreciate the irony.

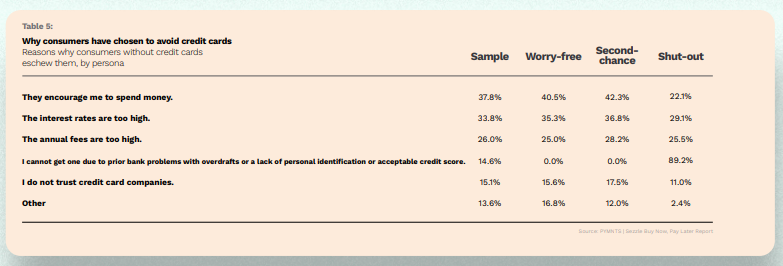

Credit cards suck, and BNPL appeals

To many consumers, credit cards simply suck.

PYMNTS’ research shows consumers fear overspending, hate high fees, and despise high interest rates. In addition, 89.2% of shut-outs hate credit cards because they simply can’t qualify to get one.

47% of respondents are interested in using BNPL for one-off purchases of expensive items, and 29% would use the service to pay medical bills.

The report notes BNPL providers have managed to attract the awareness and interest of both financially secure and financially underserved markets at the same time. “Respondents who experienced previous collections issues were the most aware of BNPL options (72% and 64% of second-chance and shut-out consumers, respectively). Worry-free consumers also have high rates of awareness (54%).”

Both research reports show strong evidence that a financial revolution is in progress, partly driven by technology and the inability of legacy systems and traditional financial institutions to respond quickly.

“Overall, 48% of BNPL users agreed with the statement that “BNPL providers are more trusted service providers than banks or credit card companies,” PYMNTS found. In addition, 64% of consumers who mostly prefer one leading BNPL program believe BNPL providers are more trustworthy service providers than banks or credit card companies.

Ouch. Banks and credit card companies have a lot of work to do!

You can get more insight from C+R Research’s Buy Now, Pay Later Statistics and User Habits blog post or the PYMNTS/Sezzle Financially Underserved Consumers 3X More Likely to Use BNPL Options at Checkout report here.

Recent PaymentsNEXT coverage of BNPL developments:

Splitit opens BNPL access to 9 billion UnionPay cardholders

Affirm plans debit card with buy now pay later feature

Buy now pay later for billion-dollar elective healthcare market

LET’S CONNECT