Lots of global payment news to cover, so let’s get right at it. We profiled 11 logistics leaders in last-mile delivery including Nuro, Boxbot, Amazon Scout, Starship, and Postmates Serve. The latest PULSE survey shows debit payments are growing and contactless is trending. Russian e-commerce will hit $22 billion by the end of this year and $50 billion by 2023. Artificial intelligence is making waves in the noisy world of debt collection.

Our global roundup looks at UK Co-op stores use of pay-in-aisle technology from ACI. Who are Canada’s newest challenger banks? We profile some of the leaders and their technology. Visa invests in Southeast Asia payments platform Gojek. Italy’s Banca Popolare di Sondrio has integrated Epiphany’s InstaPay open banking solution into its app. Tractor Supply gets traffic using buy-online-pickup-in-store (BOPIS) strategies. FIS has finally completed its acquisition of Worldpay. Enjoy your weekend and the summer weather wherever you are.

Snapshot: Leaders in last-mile delivery

Last-mile delivery is one of the biggest logistics challenges in business and e-commerce, no matter if you’re Amazon or an agile startup. In fact, whether it’s groceries, the latest electronic gadget, pizza, or your favorite summer reading novel, last-mile delivery makes up 25% of the cost of delivery for most businesses. We’ve got a snapshot of the most interesting and innovative leaders in last-mile delivery to keep your logistics team hopping, or should we say, rolling? Read more…

Debit payments growing and going digital

US consumers are paying with debit more often, and in more ways, including online shopping, online bill payments, and person-to-person (P2P) payments and momentum is building according to the Discover Financial Services’ PULSE® debit network’s 2019 Debit Issuer Study, carried out in May 2019. E-commerce and other digital transactions grew nearly 24% year-over-year – more than five times faster than debit transactions using a physical card. Read more…

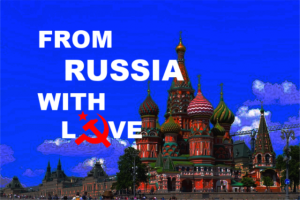

E-commerce: From Russia with love

The Russian e-commerce market should total $22 billion by the end of 2019 and is poised for growth that could reach $50 billion by 2023, according to a new research study. Russian e-commerce is estimated at 5% of the economy although it is considered to be as high as 18% in the largest cities. An estimated 35% of Russians shop online, compared with 60% in EU countries and up to 80% in well-developed countries. Read more…

AI approaches for a new debt-collection era

For decades, debt collection has relied on the same methods: repeated phone calls and letters to consumers. Not only does this take a lot of time and energy, it results in scores of complaints (debt collectors generate more complaints to the Federal Trade Commission than any other industry). Even though these methods have a low success rate, collectors still employ them. According to the recent AI Gap Report, a collaborative effort between Brighterion and PYMNTS, only 5.5% of financial institutions are using AI technology to help them improve their efforts in debt collection. Read more…

Co-op stores implement ACI’s Pay-in-Aisle tech

Co-operative Group’s new Pay-in-Aisle app will use ACI Worldwide’s mobile payments technology as an essential component. The app will be launched across 30 Co-op food stores in England, Scotland, and Wales by early August 2019. The app allows customers to scan products on their own device as they shop, and product costs are deducted from their Apple Pay or Google Pay accounts with a touch of a button. Read more…

Challenger banks in Canada: who’s who and what’s their tech

With Open Banking coming to Canada and the appetite for digital innovation, the country’s challenger banking market is poised for growth. FinTech Futures has put together a list of the current challenger banks and banking services in Canada and the tech they are using. Read more…

Visa invests in Southeast Asia’s payments platform Gojek

Visa has invested in Southeast Asia’s mobile on-demand service and payments platform Gojek. The investment was part of a Series F fundraising round, which will support the growth of Gojek’s payment services across the region. Visa and Gojek will also work together to develop digital solutions aimed at the unbanked and underserved population in Indonesia and Southeast Asia. Read more…

Banca Popolare di Sondrio adopts InstaPay

Italy’s Banca Popolare di Sondrio has integrated Epiphany’s InstaPay open banking solution into its app. The PSD2-compliant solution enables the bank’s customers to pay directly from InstaPay’s app at the touch of a button, using QR code technology. Thanks to NCR’s WinEPTS tech, the payment is completed through a simple interaction between the customer’s smartphone and the point-of-sale (POS) system. Read more…

Tractor Supply Co’s BOPIS strategy pays off in rural communities

On its Q2 earnings call, Tractor Supply Co. reported over 70% of online orders are now fulfilled in-store, which executives called an encouraging sign as the company invests in its brick-and-mortar properties and digital presence to increase market share in rural communities. According to Steve Barbarick, President and CEO of Tractor Supply, the retailer has over 100,000 SKUs on its website. Read more…

FIS completes acquisition of Worldpay

Jacksonville, Florida financial technology services company FIS (NYSE: FIS) acquired global payments company Worldpay, Inc. The amount of the deal was not disclosed. The combined organization will have over $12 billion in pro forma revenue, with a portfolio of solutions for payments, banking and capital markets. Read more…

LET’S CONNECT