Although 15% of consumers have made a biometric payment in the past year, research from Transaction Network Services (TNS) shows biometric payments are not ready to break through into common use according to a survey of more than 3,000 in the US, UK, and Australia.

Are biometric payments popular today?

In the UK, 18% of those surveyed had made a biometric payment in the past year followed by the US and Australia with 16% each.

In the UK, 18% of those surveyed had made a biometric payment in the past year followed by the US and Australia with 16% each.

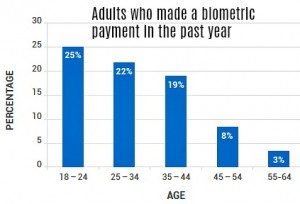

25% of 18 to 24-year-olds have made a biometric payment in the past year followed by 22% of 25 to 34-year-olds, 19% of 35 to 44-year-olds, 8% of 45 to 54-year-olds and 3% of those over 55 to 64-year-olds.

Males are biometric payments early adopters

When it comes to gender, males are not surprisingly earlier adopters of biometric payments with 18% male vs 10% female in Australia, 23%/13% in the UK and 17%/12% in the US.

What’s ahead for biometric payments?

Overall, 68% of those surveyed believe biometric payments will become commonplace in 2 to 5 years compared with 67% in 2016.

The results were consistent across all age groups when it comes to belief in the future of biometric payments.

Preferred method of biometric payments

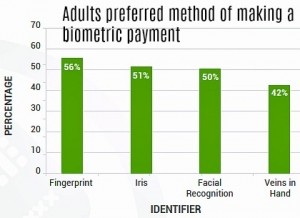

56% of consumers would be willing to use fingerprints for payments followed by Iris scans (51%), facial recognition (50%) and veins in hand (42%).

56% of consumers would be willing to use fingerprints for payments followed by Iris scans (51%), facial recognition (50%) and veins in hand (42%).

In the US facial recognition was the most popular method of biometric payments compared with Iris scans which were most popular in the UK and Australia.

Is security a concern?

In Australia, 63% were concerned about security, followed by 61% in the US and 58% in the UK.

Most age groups saw a slight reduction in concerns over security between the 2016 survey and 2018. Of concern to the industry, was a 3% increase to 66% in security concerns by 18 to 24-year-olds. There is work to do to educate consumers about security issues with biometric payments.

Globally, 62% of men and 59% of women were concerned with security although in Australia 62% of men vs 65% of women were concerned with biometric payments security.

63% of British and Australians surveyed felt biometric payments would increase the security of their payments compared to 57% of Americans.

Biometric payments takeaways

The research confirms consumers are trying biometric payments and interested in using them in the future. Consumers are more open to Iris and vein scans compared to the earlier survey in 2016.

The research confirms consumers are trying biometric payments and interested in using them in the future. Consumers are more open to Iris and vein scans compared to the earlier survey in 2016.

The industry has a job to do in convincing younger potential users and those in the US that biometric payments are safe and secure. The cost of technology and infrastructure remains a barrier at this early stage as well but biometric payments are coming in the future.

You can read the detailed TNS research results here.

LET’S CONNECT