By Jeff Domansky, October 27, 2020

Editor’s update: CNBC reported today (Nov 3) that “Ant Group’s controller Jack Ma, executive chairman Eric Jing and CEO Simon Hu were summoned and interviewed by regulators in China, according to a statement Monday from the China Securities Regulatory Commission.” The result is that the Hong Kong and Shanghai securities exchanges have temporarily postponed the company’s IPO pending clarification from the company and China regulators.

When you take off your US-centric payments industry sunglasses and look across the Pacific Ocean, you see the impact of mobile, the growing financial power of China, and the huge growth in consumer spending as China’s middle class wields its spending power.

That’s why the imminent $34+ billion IPO for Alibaba-owned Ant Group, formerly Ant Financial, is not a surprise.

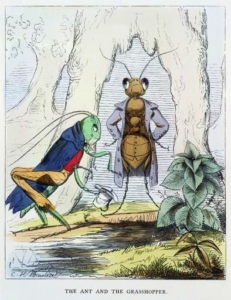

It’s a little bit like the fable of the Grasshopper and the Ant. While many big banks have taken on glamorous, risky, and hugely profitable global deal-making, Ant Group and Alipay have worked hard on its core business of payments for the fast-growing Chinese market.

The result is a very profitable business attracting the attention of investors from around the world. That’s a long way from when founder Jack Ma set up subsidiary Alipay in Oct 2004 and formalized it in 2014 to handle owner Alibaba Group’s impressive, Amazon-like e-commerce growth in China.

Scale, size, speed, technology, growth

Take these facts into consideration. Without a single branch location, Ant Group’s mobile payments service Alipay has more than 730 million active monthly users. In the first six months of this year, it handled more than $17 trillion in payments, mostly in China. And it has a base of 80 million merchants.

To put that in perspective, Alipay has twice the number of accounts as PayPal which in all of 2019 handled only $712 billion in transactions. In 2019, Ant Group reported a net profit of $2.6 billion.

Alipay also has the technology and technical expertise to handle payments on a huge scale. During last year’s Nov 11 Singles Day promotion, it processed more than 459,000 transactions per second. Visa says it can handle 65,000 payments per second.

Hong Kong & Shanghai listings signal power shift

With its decision to list in Hong Kong and Shanghai, it’s a signal of the growing financial power of China and an inevitable power shift to the region.

On Monday, within its first hour, Reuters reported the institutional book for the Hong Kong portion of the listing was oversubscribed due to ‘overwhelming’ demand. Ant Group expects to raise up to $34.4 billion in Hong Kong and Shanghai, with the offer split between the two cities, giving it a valuation of nearly $312 billion.

“The demand is overwhelming … It will smash all previous records,” Francis Lun, Hong Kong-based chief executive of GEO Securities, told Reuters about retail demand for the Ant Group offering.

The anticipated record IPO will be a fee home run for underwriting banks that include Citigroup, JPMorgan, and Morgan Stanley.

Ant will have an expected market value of at least $315 billion, according to recent filings, a comparable valuation to JPMorgan and four times larger than Goldman Sachs. The sale also establishes founder Jack Ma’s fortune at $71.6 billion, a long distance away for the former English teacher who founded Alibaba Group for just $60,000 in April 1999.

Global aspirations

Alibaba Group will own one-third of Ant Group shares as part of its sprawling global empire with high growth businesses in e-commerce, payments, and cloud computing that analysts expect will continue to deliver strong double-digit revenue growth.

Even the pandemic has failed to stem the growth of Alibaba and its subsidiaries including Ant Group, Alipay, and its Alibaba Cloud technology services. Alibaba Group saw its e-commerce business jump from pre-pandemic 22% growth to 34%. Alibaba Cloud owns 44.5% of the China market and it experienced 54% year-over-year growth.

“Alibaba believes there is significant growth ahead of the business and has set a long-term target of serving more than 1B consumers in China and achieving more than $1.4T in gross merchandise volume over its commerce platforms within the next five years,” according to a new Seeking Alpha report.

Ant – the hardest working portfolio

Ant Group may very well be the jewel in the crown of investments within Alibaba Group. Alipay claims to have a total of 900 million accounts in China alone with more than 1.2 billion mobile wallets. An estimated 28 million small businesses also use the group’s financial services.

Ant is also expanding its services more deeply into wealth management in partnership with Vanguard, micro-financing for business through its MyBank subsidiary, health insurance (Xiang Hu Bao), and credit finance.

Alipay is carefully and strategically partnering with payment providers in countries where Chinese travelers and business people visit.

By the way, if you’re planning to travel to China, you might want to read today’s New York Times article “Don’t even try to pay cash in China.” It provides real insight and a preview of a cashless society dominated by digital payments even at roadside food vendors.

In this real-life fable of the Ant and the Grasshopper, it looks like the Ant is set to succeed in the future. The $35.4 billion IPO is simply evidence of investors’ confidence in the outcome.