By Michael Kaplan, EVP, PayNearMe

What’s in your wallet? That’s a well-known slogan for a major credit card, but it’s also an important question for lenders determining which payment types and channels to offer customers.

You may be surprised to learn that for many consumers, cash is what’s in their wallet, and it continues to be an essential loan repayment option for this segment of borrowers.

With this in mind, lenders shouldn’t be quick to phase out cash options. Instead, they should digitize cash payments and encourage more cash payers to use self-service by enabling cash payment at retail locations they regularly visit, like CVS or 7-Eleven.

This might seem counterintuitive in a world where transactions are increasingly done remotely, from grocery shopping to movie-watching. However, there are compelling reasons why adding an in-person channel for loan repayment is necessary.

Why cash still counts

Here are four reasons why adding cash at retail still matters and how to make the transition to offering this payment method smooth.

- Cash at retail is a critical option for bill payers who are unbanked.

According to the Federal Reserve, 6% of US adults—about 14 million people—are unbanked, meaning they do not have a checking or savings account. The rate of unbanked consumers is especially high among low-income and minority groups, young adults and those with disabilities. For instance, 17% of those making less than $25,000 annually, 10% of adults under 30 years old, 13% of African Americans and 10% of Hispanics are unbanked.

This means many adults have few options to pay their bills besides cash. Offering cash at retail gives those customers a way to do so conveniently and securely without traveling to a central billing office.

- Cash meets a need for those who get paid in cash.

Many working Americans still earn a sizable portion of their income in cash. Think about self-employed gardeners, childcare providers, waiters and barbers. This makes for substantial cash flowing through the economy—cash used to cover bills.

When you make paying cash at retail an option, you give these workers a hassle-free way to pay their bills as soon as they get paid. They can even do so on the way home, as they stop to pick up other items at a participating retail location.

- Digital cash is easy and convenient.

When working with the right partner, cash at retail can be incredibly convenient for the customer. It can occur in the checkout line at a participating retail outlet while consumers are purchasing other products.

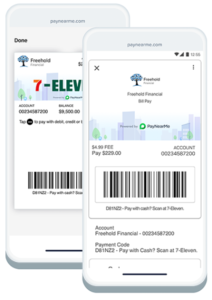

Here’s how it works: The biller provides customers with a reusable digital barcode via a mobile app, text message, email or billing statement. The customer shows this bar code to the cashier and makes the cash payment. The cashier prints out a receipt showing proof of payment, and you (the biller) receive notification of the transaction in minutes.

Cash bill payment at retail does not require the payer to have a bank account, removing an obstacle that can get in the way of on-time payment.

- Many young adults are paying all their expenses with cash.

A 2023 Harris Poll on behalf of Credit Karma showed 69% of Gen Z using cash more now, compared with a year ago. Nearly a third of this age group said they manage their budgets by “cash stuffing,” a TikTok-fueled strategy that involves setting cash aside at the beginning of the month allocated to particular categories—including bills.

Cash bill payment at retail locations fits perfectly into this paradigm, helping a new generation of billpayers use their carefully” stuffed” cash to pay bills. And because young adults are well-accustomed to using digital cash, thanks to peer-to-peer apps, they will also appreciate its usefulness in bill payments.

Orchestrating your rollout of cash-at-retail bill payment

Adding cash payment at retail locations is nearly effortless on the biller’s part, but it requires partnering with a payment platform provider that offers that payment channel and has a well-established network of participating retail locations where your billpayers already shop.

Also, the provider should offer a good funds model for these payments, as they are not subject to chargeback or returns like some traditional electronic payment methods. Ask how the provider integrates cash in its reconciliation process. You should be able to see all your transactions (cash, ACH, cards and mobile wallets) in a single file. Finally, they should provide the necessary tools to deliver their barcodes to your customers using traditional communication channels, such as email, text message, or integration into your billing app.

Once you’ve selected the best payment platform provider, you can provide your cash-preferred customers with the personalized barcodes needed to make their payment at a retail location. You can send these barcodes to interested customers through your billing app, text message, email, or paper bill.

Making payment easier: a winning strategy

Ease of bill payment matters. In PayNearMe’s recent survey, 25% of respondents said not having their preferred payment types available makes paying loans difficult.

On the flip side, when you accommodate your customers’ preferences, such as offering cash payment at retail, you make payment easier, leading to satisfied and loyal customers.

Are you ready for cash payment at retail? It’s a smart and easy way to satisfy your customers who prefer cash for bill payment, while benefiting your business at the same time.

About the Author

Michael Kaplan is the EVP and Chief Revenue Officer at PayNearMe, where he leads the company’s growth. PayNearMe enables businesses to accept cash, card, ACH and mobile-first payment methods, including Apple Pay, emphasizing user experience, satisfaction and reliability.

With more than two decades of experience in mobile and payments technology, Michael has played key roles in the strategy, development and growth of multiple platforms and markets. He is a seasoned executive in the payments, fintech, prepaid and mobile markets and has held senior leadership roles at Good Technology, Motorola and Jasper Wireless. Michael holds a BA from Rutgers University and an MA from TCNJ.