Trouble remembering your payment card PIN number? Beginning in April, two British banks will test a bank card with a built-in biometrics scanner to enable more secure payments authentication.

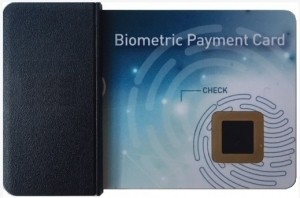

Royal Bank of Scotland and NatWest will test the new bank card with a built-in fingerprint scanner developed by Dutch digital security company Gemalto.

Bank customers in the UK are now limited to a maximum of $40 in contactless payments to reduce fraud risk although Apple Pay carries no restriction and Google Pay has a higher limit.

Easy biometrics authentication

Customers would go to a bank branch and use a kiosk or tablet to record their fingerprint and verify their identity. The fingerprint data is only stored on the card and saved at the bank as a series of encrypted numbers to protect consumer identities from fraud.

Bank customers could eventually register their fingerprint themselves using their mobile phone as the technology evolves.

The biometric bankcard would not require new point-of-sale machines and simply uses POS terminal power to enable the card authentication.

Samsung makes iris scans available and Apple Pay allows Face ID and Touch ID payments. Google also lets users enable smartphone fingerprint scanning and authentication for payments, and the biometrics technology has been used in tests in Cyprus, Italy, Romania and South Africa.

Biometrics are commonly used in many medical and security applications and analysts predict there could be more than 2.6 billion biometric payments users by 2023.

Some wonder if carrying an additional biometrics card is necessary when smartphones can already be used to make payments. But the technology could be provided for free on bank cards for those who can’t afford or prefer not to pay with their smartphone.

If the Royal Bank of Scotland and NatWest tests are successful, biometrics bank cards could become common and forgotten PIN numbers a distant memory.

Gemalto is pioneering biometrics and digital security in banking and other business sectors and you can get a quick preview of their EMV payments technology in the video below.