By Douglas Hall, Founder & CEO of EQUE

If you’re a financial institution or merchant hoping that chargebacks will plateau anytime soon, I’ve got news for you: they won’t. The just-released 2025 State of Chargebacks report from Datos Insights and Ethoca confirms what many of us in fraud prevention have felt for a while — we’re not just seeing a spike but watching a structural shift.

And it will cost us unless we change how we fight back.

Chargebacks Aren’t Just Growing — They’re Escalating

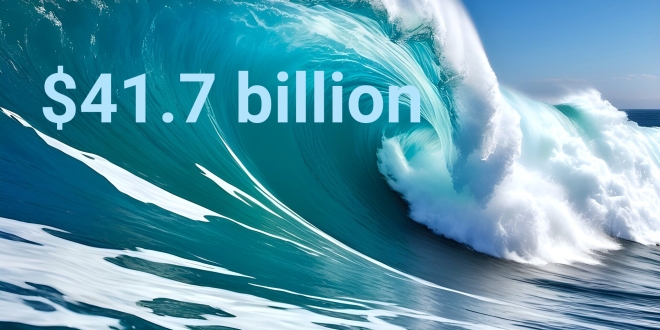

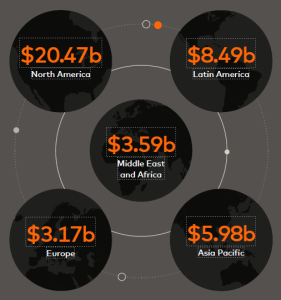

Global chargeback volume will hit 324 million transactions by 2028, up 24% from 2025. That’s not just friction — that’s financial leakage on a worldwide scale. And it’s not just volume; it’s value, too. The report pegs the total dollar impact of chargebacks at $41.7 billion globally by 2028.

What’s driving this? A few things:

- The explosion of card-not-present (CNP) transactions — now making up over 60% of digital commerce

- Subscription-based purchases, where customers forget they opted in

- A rising tide of first-party fraud, where consumers dispute legitimate transactions

- Legacy dispute management systems that can’t keep up

None of that surprises you if you’re running fraud ops or managing payment risk. But what might? Issuers and merchants still handle most chargebacks manually.

Manual Doesn’t Scale. And It Doesn’t Win.

Here’s the reality: traditional processes are losing ground fast. FIs in the US are dealing with 30–40% more disputes simply because mobile banking apps make filing them easier. Yet too many back-office teams still chase evidence manually, burn time on low-dollar disputes, or worse, write them off entirely.

Merchants aren’t in much better shape. A quarter now handle more than 1 million chargebacks a year, and some industries — travel, hospitality, gaming — report an average dispute value of $120 or more.

We’re bleeding time, trust, and money. And customers? They’re switching loyalties. Half say they’d ditch their bank if the dispute process isn’t digital and intuitive.

The Real Cost of Chargebacks

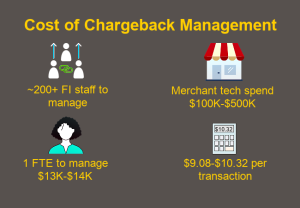

For financial institutions, the numbers are brutal: each chargeback costs $9.08 to $10.32 to process. One full-time employee is required for every $13K to $14K in incoming disputes. Some US banks are running 200+ back-office employees dedicated to chargeback management, costing millions annually in staffing alone.

Chargebacks are more than a fraud issue — they’re an operational burden that drains staff, budgets, and tech resources.

Merchants aren’t spared either. Many are spending $100,000 to $500,000+ per year on chargeback-related technology. Twelve percent of large enterprises saw a 25%+ increase in tech spending over the last year alone. When you factor in average chargeback values ranging from $94 to $120, the impact on margin is hard to ignore.

The First-Party Fraud Problem No One Wants to Talk About

Here’s where it gets even more serious. According to the report, combined first- and third-party fraud drives 45% of merchant chargebacks. That stat should send a chill down your spine.

Why? Because first-party fraud isn’t just criminal — it’s behavioral. Customer expectations, confusion or, in some cases, outright exploitation of the system drive it. And most dispute systems weren’t designed to catch it. That’s where EQUE is focused — combining real-time data, behavioral signals, and dynamic verification to tell the difference between real fraud and refund abuse.

Representments Work. So Why Aren’t More Merchants Doing Them?

The data is clear: Merchants win 50%+ of representment cases, and FIs win about 75% of the ones they challenge. So why don’t we see more of it? Because representment is only worth it if you can scale it. And you can’t scale it manually.

The smartest teams are automating their evidence-gathering, using AI to flag transactions worth challenging, and reducing review times from days to seconds.

What Needs to Happen Next?

If you’re a merchant or FI reading this, here’s what I think this report should make you do:

- Automate your intake and analysis. Manual review is dead weight. It won’t scale with 25% growth.

- Invest in customer clarity. Digital receipts, clear merchant IDs, and purchase insights reduce confusion and disputes.

- Don’t ignore first-party fraud. Treat it like a risk segment, not a customer service glitch.

- Collaborate. Issuers and merchants must share data to identify patterns and stop abuse at the source.

We built EQUE because we saw this coming. A smarter dispute system isn’t optional— it’s an essential infrastructure for digital commerce. And if we don’t act now, we’ll be paying the price in operational drag, customer churn, and fraud-driven revenue loss for years.

Let’s build systems as fast and smart as the fraud we’re fighting against.

About the Author

Douglas Hall is the CEO and Founder of EQUE Corp, an innovative e-commerce fraud prevention service that uses dynamic CVV technology to create “person present” transactions, eliminating card-not-present and friendly fraud and significantly reducing false declines. He is a leader in the global payments industry with decades of experience in finance, a serial entrepreneur, and the publisher of PaymentsNEXT.

Recent PaymentsNEXT news:

Banks are investing in AI, but are customers ready for change?