by Jim Merchant, Senior Program Director at BHMI

Facing rising costs, competition, and complexity, many companies in the payments space are continually seeking new ways to optimize transaction-based fee revenues.

However, financial services companies such as payment service providers, networks, and banks often struggle to remain agile and competitive in this rapidly changing world of payments. Not having a flexible and competitive fee structure can negatively impact customer retention and profitability.

Some companies are overcoming this challenge by adopting solutions to support rules-based fees. When leveraging the right platform, a rules-based approach enables companies to quickly assess, assign, and modify any fee via configuration rather than being held back by timely and expensive software code changes. This approach enables companies to be extremely agile and competitive with their fee structures.

Evolution of Payments

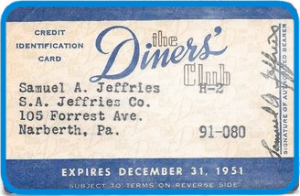

The payments industry has grown tremendously over the past seventy years. The idea of cards came to market in 1950 when the Diners Club Card was introduced in New York City. Bank of America rolled out the first credit card to select customers in 1958, and by 1966, a group of banks in California created what would eventually become Mastercard. E-commerce took things digital in the 1990s, and by 2011, mobile payments had begun to take off. Today, P2P payments and real-time payments are making digital transactions ubiquitous and faster than ever.

Over time, the volume of payments, complexity, and number of participants in each transaction have grown. For example, a simple card transaction now involves several parties, including the customer, merchant, third-party processor, card network, and issuing bank.

As the number of electronic payment options and transaction participants increases, payment processing companies need new ways to stay in business in the fiercely competitive market. One of the primary ways to compete is through transaction-based fees. Below are just a few types of fees commonly used in the payments industry:

- Interchange Fees

The acquirer pays interchange fees to the issuer, typically based on a fixed amount per transaction type and a percentage of the total transaction amount. Rates are set by the various payment card networks and determined by factors like the transaction amount, payment card type, acceptance method, and industry type. - Service Fees

Payment service providers often charge service fees to cover business costs and earn a profit. These additional fees can be a flat fee, a percentage of the transaction, or a combination of the two. However, service providers can be creative in their pricing structures to address the needs of their clients. - Gateway Fees

Gateway providers often charge separate fees to connect the payment service provider to the gateway. Fee structures vary with each provider but can consist of a monthly fee, a flat fee per transaction, a percentage of a transaction amount, or a combination of all three. Additional fees may be assessed if the payment gateway provider supplies equipment like POS devices.

There are many types of transaction-based fees in the payments industry, and in a highly competitive market, the types of fees and pricing structures are constantly changing and unique to every business.

Determining the Appropriate Transaction Fees

Transaction-based fees offer several advantages, starting with the opportunity to generate additional revenues and a steady income stream. These fees can also help offset costs associated with services and products. However, the administrative burdens and transparency issues of new fees can increase complexity.

There are several things companies must consider when setting transaction fees, such as direct and indirect costs associated with the transaction. Companies should also remain transparent by clearly communicating fees to customers and providing detailed fee breakdowns.

A Rules-Based Approach for Fees

One of the main challenges payment processing companies face is not being able to modify fee structures quickly. This can make it difficult to remain competitive and introduce new initiatives into the pricing strategy without significant software developments.

Fortunately, rules-based software solutions now allow companies to create any fee on any payment transaction. This enables users to configure as many fees as needed in a pricing strategy without software changes or system downtime. Below are just a few examples of the type of fee structures that can be easily implemented with a rules-based fees solution:

- Flat fees in the form of a fixed cost regardless of the transaction size

- Fees based on a fixed amount per transaction and a percentage of the total transaction amount

- Threshold fees with minimum and maximum thresholds for both transaction counts and amounts

- Tiered pricing, where each tier has a specific fee that decreases as each higher tier is reached

- Volume-based fees, where a reduced fee applies to all transactions depending on when a particular volume is reached

- Pass-through fees, which are calculated by another party and are included in the transaction data

Although calculating and managing so many fee types can seem complicated, a rules-based fees engine simplifies and automates the management of complex fee structures.

For example, it can access data in real time to decide which fees to apply while the transaction is still in flight or after the transaction has been saved in a centralized transaction repository. It can also enable different fee structures to take effect at specific points in time, enabling companies to test and refine fee structures as they go. Organizations can also view real-time fee revenues and analyze the financial impact of fee structures to determine if they need to be adjusted.

A rules-based fees engine offers unlimited flexibility to configure any transaction-based fee. It also enables companies to test and refine their fee structures to remain competitive in a rapidly changing marketplace.

About the Author

Jim Merchant is Senior Program Director at BHMI. He has been in the payments industry for more than 30 years and is currently supporting large financial services companies that are modernizing their payments back-office, including the implementation of rules-based fee solutions.