By Jeff Domansky

As PayPal’s CFO saw Tuesday, some earnings calls provoke unexpected consequences. In an effort at transparency, and because it is material, CFO John Rainey revealed inflation and supply chain challenges impacted consumer spending, and PayPal would likely not reach its ambitious goal of 750 million active customer accounts by 2025.

Rainey also disclosed that new account bot fraudsters had swamped the global payments company with 4.5 million estimated phony accounts created by bot farms. All to take advantage of $10 account opening incentives in 2021. Talk about a marketing program going off the rails.

Rainey said, “We regularly assess our active account base to ensure the accounts are legitimate.” Fortunately, PayPal’s fraud detection team was also on the job.

“This is particularly important during incentive campaigns that can be targets for bad actors attempting to reap the benefit from these offers without ever having an intent to be a legitimate customer on our platform,” Rainey added in the Q4 earnings call.

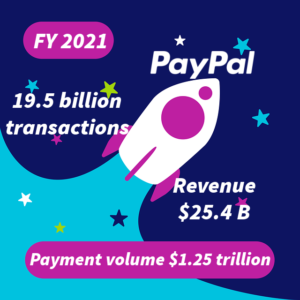

PayPal is a payments industry powerhouse

The market response to the PayPal Q4 earnings call was swift and painful. Shares dropped 25% yesterday, according to Bloomberg. Today, analysts and the market are still assessing the company’s-term prospects.

But it’s essential to look beyond the next 30 days and typical daily market fluctuations.

PayPal is among the payments industry leaders and a big success story. It added 48.9 million (+13%) net new accounts (NNA) in 2021 and now has 426 million active accounts. Give or take a few bot farms.

The company handled 19.5 billion transactions (+25%), and total payment volume (TPV) was $1.25 trillion (+31%), according to company financials. Net revenue was $25.4 Billion (+17%) in 2021, and PayPal projects revenue growth of 15%-17% in 2022.

These are impressive results by any measure.

Fintech fraud is a growing problem worldwide

The fintech world battles fraud every day. However, according to Frank McKenna, cofounder of fraud prevention firm Point Predictive, it’s a growing problem. He told Forbes, “This is the first time I have seen a company acknowledge that fraudsters can take advantage of these new account programs with such scale.”

He said PayPal’s admission of 4.5 million for the accounts indicates other fintechs may be facing a similar problem although not reporting it. “How much of the growth in some of these fintech portfolios could be fueled by these bots that are creating accounts just for collecting the incentive?” McKenna asked. “I think every fintech should look at accounts that signed up with incentives but never used the account again.”

“This is a systemic issue that we’re seeing at many banks and fintechs,” says Mary Ann Miller, a vice president at phone-centric identity company Prove. “It’s related directly to the identity theft and synthetic fraud that we saw during the pandemic. Bad actors are weaponizing the personal information that they’ve stolen in data breaches and using bots to launch attacks. They’re going to all kinds of fintechs and attacking their account-openings processes.”

Miller said digital identity today is under fire. “Protecting organizations of all sizes from automated scripted bot attacks that leverage consumers’ personal identity information requires several layers of advanced security and bot detection protection, beyond the organization’s firewall. Many institutions – even large banks and government institutions, are assessing more modern ways to combat these attacks, including modern digital identity proofing.”

Robust digital identity-proofing must be widely adopted. With digital identity-proofing, consumers verify their identity through a mobile device, document scan, or other strong proof to establish their identity before being allowed to open accounts or utilize other financial services.

Fraudsters actively search for institutions without proper digital identity-proofing in place, often comparing tactics on Telegram, Reddit and on dark web message boards to let other criminals know of new security loopholes.

Financial fraud is a problem that’s going to get worse before it gets better. Fraudsters are smart, creative, armed with the data and the best technology tools available, and motivated to exploit financial system weaknesses.

Analysts mostly positive about PayPal

Early reaction to PayPal’s future prospects from analysts was generally positive, according to Benzinga.

JPMorgan analyst Tien-tsin Huang projects 20% revenue growth saying the company’s guidance was “broadly disappointing, but probably necessary to reset expectations in order to get back to beating and raising expectations.”

James Faucette at Morgan Stanley said investors were “probably overly preoccupied” by the reduced emphasis on net new account growth and should be looking more at overall e-commerce growth.

Raymond James analyst thought the stock is fully valued and 20% growth may be optimistic, but JMP securities analyst David Scharf called the growth headwinds “transitory.”

Lisa Ellis, an analyst at MoffettNathanson, said in a note to clients, “You can officially add PayPal to your list of pandemic high-fliers that are experiencing a quite-bumpy landing.”

Marketing lesson learned I guess.

Fraud prevention must be on the radar

According to Nilson Report, by 2030, total payment card volume could reach an estimated $79.14 trillion, but the industry will lose as much as $49.32 billion to fraud.

Financial institutions, the payment industry, and fintechs need to up their fraud prevention game right across the board.

That should be more than enough incentive for fintech innovators to come up with new fraud prevention solutions and bring them to the financial marketplace.

More PaymentsNEXT news:

Visa and Mastercard’s new approach to direct selling explained

3 trends driving the digital identity market in 2022