By Jeff Domansky, April 26, 2021

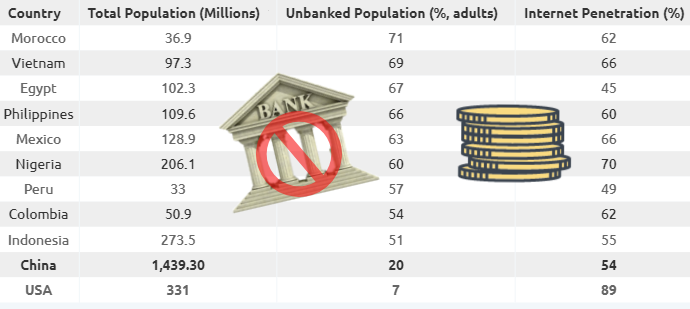

Any idea who the world’s biggest unbanked countries are?

New data from Finbold paints an interesting picture of the largest unbanked populations. It also raises a few interesting possibilities about the potential opportunities for fintech companies.

Unbanked still surprisingly large

First, a look at those countries with the highest rate of unbanked citizens and a few observations.

Morocco has the highest rate of un-banked with 71%, followed by Vietnam (69%), Egypt (67%), Philippines (66%), Mexico (63%), Nigeria (60%), Peru (57%), Colombia (54%), and Indonesia (51%).

For those of us in more developed nations, it’s easy to take our access to technology and the modern financial system for granted. In Morocco, Vietnam, Egypt, and the Philippines, more than two-thirds of the total population is still un-banked.

I was surprised that Egypt, the Philippines, and Mexico still had such a large percentage of unbanked citizens and that Indonesia was lower than I imagined.

You read so much about the quick adoption of mobile, the promise of technology, and the cheerleading about fintech in developing countries. It’s easy to forget the reality on the ground in other parts of the world.

It’s not easy for people and economies to transition from old practices and familiar financial systems. But the sheer size of the challenge is also an enormous opportunity for fintech.

US-China perspective

China’s unbanked population is 20%, while the US is 7%. The report explains:

“Based on China’s economic standing globally, the 20% unbanked population can be considered significant. However, the figure mainly constitutes people who live in rural areas where a majority have no access to essential financial services like bank accounts. In most cases, these regions lack banking branches. Rural households are also less educated with lower income streams. Additionally, the percentage correlates with the country’s 1.4 billion population.”

Still, that’s nearly 288 million Chinese without the kind of financial access we take for granted. That’s 2.8 times higher than the US rate. With only 54% penetration in China, the rural areas will be slower to adapt and adopt new systems until mobile penetration grows.

Yet I’m surprised the US number of 7% un-banked is that low. Reading US news coverage, I would’ve guessed that number to be closer to China’s 20%.

Coronavirus a catalyst for fintech

The Finbold report talks glowingly about the possibilities for fintech.

“The shift from physicals to online banking coupled with internet penetration will drive financial inclusion,” writes Oliver Scott.

That may be true in developed western countries, but the shape of financial inclusion and development looks much different in developing countries. Access to mobile technology is increasing quickly across Asia and Latin America, bypassing the evolution of technology and telephony we experienced.

In surprising and encouraging stories in India, Africa, and across the Middle East, we see instances of mobile technology providing access to banking and services. It’s revolutionary in those regions, not evolutionary, and it’s not yet at scale.

Raising the rate of financial inclusion

Scott says digital assets may reduce the unbanked population. “The rate of the unbanked population might decrease in the future, especially with the emergence of digital assets. The decentralized nature of cryptocurrencies makes them bypass any control and bring opportunity to users,” he says.

I don’t share his optimism about the speed of change. China is the best example with its initial resistance to cryptocurrency and then its moves to create a national digital currency now underway.

But cryptocurrency for consumers is notoriously hard to utilize despite its unveiling in 2008. 13 years later, we’re still trying to figure out a reason for its existence despite vast amounts of money, investment, energy, and sometimes distractions.

The adoption of mobile payments in China is astonishing in many ways. But I wouldn’t count on governments in developed and less-developed countries opening the floodgates to digital assets without control.

That fintech forest is filled with trees

When it comes to fintech opportunities, it’s hard to see the forest for the trees. Some markets move faster than others. E-commerce was a natural response to the pandemic but hasn’t yet easily crossed over from developed to less-developed countries.

It’s an evolution, not a revolution. When you think you have a breakthrough like fintech or cryptocurrency, opposing forces react. Consumers like familiar finances, facts, and fashions. So do governments.

But every so often, a Genghis Khan, Picasso, Edison, Einstein, Steve Jobs, Jeff Bezos, or Elon Musk emerge to remind us that revolutions do happen. Disruption moves us forward while the rest of the population catches up until a revolution is fully underway.

At times it feels like fintech is a revolution underway, and yet I think in so many ways, it’s still a series of skirmishes and disruptions until the rest of the world catches up. When that fintech forest is filled with new growth, we’ll know that financial inclusion is not far behind for the rest of the world.

After this pause for reflection, join us tomorrow when we resume coverage of the disruptions taking place in fintech and the global payments industry.

Recent PaymentsNEXT fintech trends stories:

Beanworks acquisition highlights payments automation growth

Payment, Non-bank Lenders Loan More Than Traditional Banks

Post-Covid consumer payment & fintech strategies