Today, we’ve got a roundup of news, new developments and trends in mobile payments. Forget bitcoin and mobile payments. According to a report in the International Journal of Banking, cash payments are still king in most developed countries where the number of banknotes in the circulation have doubled since 2005 to $1.48 trillion and €1.1 trillion. While contactless payments are on the rise in the UK, so far consumers are not overly impressed with current choices says a new research report.

Today, we’ve got a roundup of news, new developments and trends in mobile payments. Forget bitcoin and mobile payments. According to a report in the International Journal of Banking, cash payments are still king in most developed countries where the number of banknotes in the circulation have doubled since 2005 to $1.48 trillion and €1.1 trillion. While contactless payments are on the rise in the UK, so far consumers are not overly impressed with current choices says a new research report.

To no one’s surprise, Apple did not approve the Samsung “Pay Mini” app for the Apple iOS Store. Starbucks is proving to be an unlikely winner with more than 7 million US orders placed via mobile devices and 15% paid by mobile. Brands are taking advantage of mobile apps for sales as well as payments with chatbots on the horizon, according to a report in MediaPost.

Google launched its Android Pay mobile wallet in Japan in more than 470,000 locations that already accept Rakuten’s e-pay service. 75% of Hong Kong residents are now using mobile payments and nearly 50% using peer-to-peer (P2P) transfer services according to Jetco survey.

A recent New York Times story profiled a small street food vendor who had no choice but to switch to mobile payments after Indian demonetization and now handles 40% of his sales by mobile. It’s created a boom for Indian mobile payments companies. Meanwhile, Qualicomm issued a report saying no mobile payment platforms in India were secure. Now that’s a wake-up call.

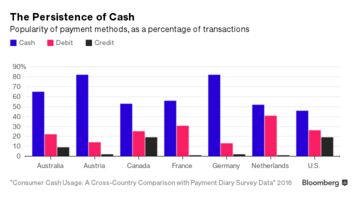

Forget Bitcoin and Mobile Pay. Cash Is Still King of the World

Everywhere you look, someone is trying to kill off cash.

Everywhere you look, someone is trying to kill off cash.

India eliminated 23 billion notes from circulation in an effort to fight tax evasion and corruption. Bitcoin and mobile payments are still hyped as the wave of the future while credit cards offer increasingly aggressive rewards. An influential U.S. economist wants to stop printing denominations of $20 and above. His goal: help central banks impose negative interest rates as monetary policy.

But try as everyone may, cash registers are still bursting with paper bills and metal coins. Cash is alive and well, according to a new study of the spending habits of more than 18,000 people in seven countries. Via bloomberg.com

Cash to account for less than a quarter of US transactions by 2026

The increase of electronic payments use, from 63% of transactions today to 76% in 10 years times, means that the value of non-cash payments in the Americas will reach $44 trillion.

The increase of electronic payments use, from 63% of transactions today to 76% in 10 years times, means that the value of non-cash payments in the Americas will reach $44 trillion.

In the UK, the demise of notes and coins will be almost as great, with the percentage of transactions not involving cash growing from 55% in 2016 to 68% in 2026, bringing total non-cash payments to £1.44 billion.

Much of the move to e-payments will be driven by contactless payments, which will see their numbers grow in the US from 38 million this year to 221 million in 2026. In the UK the rise will be from 3.3 million to 19 million.

While contactless cards are already ubiquitous, at least in the UK, the research shows that mobile payment options – from Apple Pay to banking apps to Zapp – are still failing to capture the public’s imagination. Via finextra.com

Apple Rejects ‘Samsung Pay Mini’ App for iOS App Store

Regardless of individual opinion on the firm grip that Apple holds over the iOS App Store, we can safely assume that it isn’t going to go away, or indeed loosen, any time soon.

Regardless of individual opinion on the firm grip that Apple holds over the iOS App Store, we can safely assume that it isn’t going to go away, or indeed loosen, any time soon.

The Cupertino-based company likes to cling to the belief that it’s preserving quality of apps by putting each submitted piece of software through an approval process with the sole hope of offering and maintaining a certain level of user-experience. In the case of ‘Samsung Pay Mini’, the iOS app which looked to bring Samsung’s mobile payment platform to iOS, Apple clearly doesn’t see a fit for its users, and as such has rejected its approval for the App Store for undisclosed reasons.

Samsung Pay

For the uninitiated, Samsung Pay Mini is a very simple mobile payment service utilizing Samsung Pay that the South Korean company is going to unveil to an excited crowd during next year’s Consumer Electronics Show (CES 2017) in the first week of January.

Like Apple Pay and Android Pay, it seems that Samsung Pay Mini would basically allow customers to transact for goods and services on a contactless basis by having payment methods registered against the app. It looks as though Samsung had hopes of expanding this payment service to devices other than its own, but the hope of having access on Apple devices has all but been killed off by Apple’s decision to reject the app submission. Via redmondpie.com

Starbucks: The Unlikely Winner in Mobile Payments

Payments companies have traditionally been among the most financially attractive out of the whole FinTech array in addition to being the most represented globally. However, a conventional type of payments service provider (PSP) is not all there is to payments.

Payments companies have traditionally been among the most financially attractive out of the whole FinTech array in addition to being the most represented globally. However, a conventional type of payments service provider (PSP) is not all there is to payments.

As financial technology brought new types of shareholders into the scene, the payments segment was not an exclusion with the emergence of non-financial companies gaining power and attention. Examples of such companies include coffee chains, ride-sharing companies, e-commerce and social media giants. And most interestingly, even without naming, everyone would know which companies those are exactly. At the moment, let’s focus on a unique case of a non-financial company-wide focus on mobile payments experience, embodied by strategic partnerships and developments.

Starbucks is the real winner in the mobile payments game

Starbucks is one of the most vivid examples of the role that an outsider can gain in the financial services industry. The coffee chain company owes its success with mobile to a streamlined experience, which starts without customer even leaving the house. Bloomberg reported that in February, about 7 million orders were placed through mobile devices in US cafés. The order-ahead feature already accounts for about 15% of those payments, and 3% of total transactions. Via letstalkpayments.com

2017: Messaging Apps Will Drive Mobile Payments, Change Ad Metrics

2017 will be the year that brands and marketers ask: How can I deploy dollars in mobile messaging in a way that is authentic and complimentary to my overall digital strategy? To answer that question, consider the top three projections that will shape the evolution of messaging apps as an effective advertising tool.

2017 will be the year that brands and marketers ask: How can I deploy dollars in mobile messaging in a way that is authentic and complimentary to my overall digital strategy? To answer that question, consider the top three projections that will shape the evolution of messaging apps as an effective advertising tool.

1. Brands put their money where their mouth is with mobile payments. The proliferation of mobile messaging apps has positioned messaging as a favorable vehicle for e-commerce and m-commerce. Mobile payments via messaging apps empower brands, big and small, to reach customers in an environment where they’re already spending most of their time. This makes it an ideal channel to service and sell to customers.

Add to that the emergence of chatbots, which can humanize the shopper’s experience, and we’re left with a huge opportunity, especially for retail brands, to engage with their audience and build brand loyalty while driving transactions. Via mediapost.com

Google’s Android Pay mobile wallet arrives in Japan

Android Pay, Google’s mobile payments service for phones running the OS, is up and running in Japan, two months after Apple’s rival service went live on the island nation.

Android Pay, Google’s mobile payments service for phones running the OS, is up and running in Japan, two months after Apple’s rival service went live on the island nation.

The launch will allow Android handset owners to use their devices to complete transactions at more than 470,000 locations that already accept Rakuten Edy, a prepaid e-money service, Google said in a statement Monday. The search giant’s latest attempt to spur people into paying for items using their phone launched in the US in 2015 and is now accepted in UK, Ireland, Poland, Singapore, Australia, Hong Kong and New Zealand. Via cnet.com

Mobile payment, P2P transfer services are gaining popularity in Hong Kong, survey finds

The survey, commissioned by the cash machine operator and carried out by consumer research firm Cimigo, found that 76 per cent of those polled were users of mobile payments, while 43 per cent make P2P transfers. Both services are most popular among users aged between 26 and 35 years of age, according to the survey.

“Today, using mobile payments is more secure than credit cards,” Jetco chief executive Angus Choi said. “A credit card is a piece of plastic, everything is static. But mobile phones have anti-hacking, online fraud detection. Via scmp.com

India Hobbles Through a Cash Crisis, and Electronic Payments Boom

“After the currency ban, my sales came down sharply,” said Mr. Mandal, who sells dumplings from a handcart in a market in the New Ashok Nagar neighborhood. “Providing change was a big problem.”

“After the currency ban, my sales came down sharply,” said Mr. Mandal, who sells dumplings from a handcart in a market in the New Ashok Nagar neighborhood. “Providing change was a big problem.”

After a customer suggested that he take electronic payments, he downloaded software that allows him to accept such transactions on his phone. Forty percent of his sales are now conducted electronically, he says.

Even merchants who do not have smartphones are contemplating buying one. “If people are flying in planes, how long we can ride on bullock cart?” asked Sunil Jaiswal, who charges less than $2 to repair watches in an alley near Connaught Place. Via nytimes.com

Qualcomm: None of mobile payment apps in India fully secure, warns Qualcomm

While the government is pushing for digital payments through mobile phones, chipset maker Qualcomm said that wallets and mobile banking applications in India are not using hardware level security which can make online transactions more secure.

While the government is pushing for digital payments through mobile phones, chipset maker Qualcomm said that wallets and mobile banking applications in India are not using hardware level security which can make online transactions more secure.

“You will be surprised because most of the banking or wallet apps around the world don’t use hardware security. They actually run completely in Android mode and users password can be stolen. Users use fingerprint which might be captured … in India that is the case for most of all digital wallets and mobile banking apps,” Qualcomm senior director, product management Sy Choudhury told reporters here.

He said that even most famous digital payment application in India is not using hardware level security. “Reason we are saying that none of them is using it because we work with OEMs (original equipment makers),” Choudhury said. Via timesofindia.indiatimes.com