When it comes to online fraud, US Thanksgiving was a turkey for online sellers as online fraud jumped 29% compared to 2018 according to new research from fraud prevention firm iovation. The company estimates 15% of total holiday long weekend online sales were potentially fraudulent.

With online shopping sales of $81.5 billion from Nov 1 through Dec 2 according to Adobe Analytics, that means fraud could possibly cost businesses more than $12 billion to date.

“This data, unfortunately, reinforces the fraud fears that consumers expressed in our recent survey,” said TransUnion Senior Vice President of Business Planning and Development, Greg Pierson. “Among the conclusions from TransUnion’s 2019 Holiday Retail Fraud Survey: nearly half of all consumers, 46%, are concerned with being victimized by fraudsters this holiday season with baby boomers being the most concerned of any generation at 54%.”

Fraud grew as holiday shopping approached

Researchers found that possible online fraud accelerated as the Thanksgiving holiday shopping weekend peak approached.

From Nov 28 through Dec 2 this year, iovation said 15% of transactions were potentially fraudulent compared to 13% during the Thanksgiving shopping weekend in 2018 and 11% over the same period in 2017.

That’s not a happy trend for retailers and other online sellers.

Black Friday was biggest day for fraud

iovation also broke down the fraud stats day by day over this year’s five-day holiday shopping weekend. 25% of all suspected fraud over the five-day period occurred on Black Friday. Cyber Monday had 21% of all potential fraud over the five-day period, Saturday, Nov 30 had 19%, and Thanksgiving Day and Sunday, Dec 1 each made up 17%.

While online sellers were delighted with the growth in sales this year, the accompanying growth in suspected fraud casts a cloud over some of the sales celebrations.

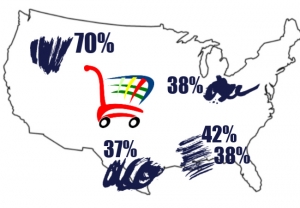

Oregon & Louisiana fraud hotbeds

Oregon and Louisiana were surprising leaders in the number of potential fraudulent online transactions during the holiday weekend. They show that online fraud can originate anywhere.

The top five US cities and the percentage of their suspected fraudulent transactions were:

- Boardman, Oregon – 70% of weekend transactions were potentially fraudulent from this West Coast town.

- Pineville, Louisiana – 42% of transactions

- Alexandria, Louisiana – 38% of transactions

- Ironton, Ohio – 38% of transactions

- Victoria, Texas – 37% of transactions.

According to the research, it’s not yet entirely clear why these smaller towns had such a large number of fraudulent online transactions other than the work of sophisticated fraudsters resident there or bots operating from elsewhere.

“We don’t have specific insights at this moment into why Boardman, Oregon but it could be the work of one or two people, bots or a fraud ring that just happens to be based in this small Oregon town,” said Angie White, an iovation fraud prevention manager.

International fraudsters were busy too

The actions of fraudsters got even more interesting as iovation identified the top five countries and the biggest sources of suspected fraud.

Countries with the highest percentage of estimated fraudulent transactions during the Thanksgiving shopping weekend included:

- China – 57% of transactions over the holiday weekend were suspected fraudulent

- Central African Republic – 57% of transactions

- Lebanon – 45% of transactions

- Sudan – 44% of transactions

- Marshall Islands – 33% of transactions.

Clearly, overseas transactions are a challenge and a warning sign for merchants. A thorough fraud prevention program would quickly identify and more strictly verify or block transactions from countries with such a high percentage of fraudulent transactions.

“These findings back our observations that a higher percentage of fraud compared to legitimate transactions generally comes from APAC and Africa. When it comes to quantity of suspected fraud, that’s a different story,” White explained.

Mobile sales grew, so did mobile fraud

iovation also found that consumers increasingly used a mobile phone or tablet for 63% of their online transactions during the start of the 2019 holiday shopping season. That’s up from 58% for the same period in 2018 and 56% for the same period in 2017.

For the holiday shopping weekend, the number of retail transactions from a mobile phone compared to all e-commerce transactions were substantial: Saturday, Nov 30 (67%), Sunday, Dec 1 (66%), Thanksgiving Day (64%), Black Friday (63%), and Cyber Monday (51%).

“Year after year it becomes clear that when not at work, consumers increasingly prefer using their mobile devices to make retail purchases due to their convenience,” said iovation’s Senior Director of Customer Success, Melissa Gaddis. “Once at work when they’re at their desk, consumers turn to their desktop and laptop computers to make purchases.”

Unfortunately, mobile is also now the preferred method for fraudulent online retail transactions. iovation found that a mobile phone or tablet appeared to be used for 63% of all suspected fraudulent e-commerce transactions during the long holiday shopping weekend compared to 59% from the same period in 2018 and 51% from the same period in 2017.

Fraud is a moving target

The large number of fraudulent transactions and their overall growth during the busy holiday season shows how challenging it is for retailers to balance between handling the much higher volume of transactions while not unnecessarily blocking legitimate transactions to reduce fraud.

Fraud is a moving target and sellers have no choice but to up their fraud prevention game, especially during the busy holiday sales season.

iovation is the fraud prevention arm of TransUnion and you can read more about the 2019 holiday sales fraud data here.

LET’S CONNECT